What is an NFT? A Guide to Non-Fungible Tokens

Published:

Readtime: 13 min

Every product is carefully selected by our editors and experts. If you buy from a link, we may earn a commission. Learn more. For more information on how we test products, click here.

If you’ve been keeping an eye on the digital art world, you would have probably found yourself asking “What is an NFT?”. In fact, it has been such a popular question over the last year that someone should turn it into an NFT. But at the risk of sounding contrived, non-fungible tokens have become an unavoidable piece of pop-culture content. From top-selling memes, William Shatner’s dental X-rays, Jack Dorsey’s first Tweet, non-fungible tokens, blockchain technology, Ethereum, Beeple, and other relevant concepts, NFTs pull the evolving concepts we see on the news and turns them into (almost) art. Let’s bridge the gap between these various buzzwords and hopefully bring you up to speed in the process. Here’s everything you need to know about NFTs.

You’ll also like:

Stock Investing 101 – What is an IPO?

What is an NFT?

The letters NFT stand for “non-fungible token” to infer a unique and one-of-a-kind entity. In the same manner that no two Picasso paintings are exactly the same, nor are any two NFTs. Compare that to say an American dollar bill or a Bitcoin, both of which are “fungible,” meaning you can swap one out for another of its exact kind (technically speaking, both dollar bills and Bitcoins have unique serial numbers or codes, but you get the point). If you own an NFT, you are the one and true owner of that one and true particular token.

Here in Australia, the NFT market has grown significantly, particularly over the 12 months. What started as a niche category has gone mainstream, according to Ray Brown, market analyst at CoinSpot.

“Typically NFTs were reserved for “cypherpunks” and “crypto nerds”, but now they have hit the mainstream. The market has really transformed over the past year,” Brown tells Man of Many. We’re seeing the applications of NFTs expand beyond digital art into categories such as video games, music, luxury fashion, sports memorabilia and collectables and even social media. More everyday Aussies are getting part of the hype too, especially with NFTs that are a bit more affordable and accessible.”

Whilst most commonly associated with digital art, NFTs have already commodified an impressively broad—and frequently wild—spectrum of entities. If it can exist on the Internet in a unique form, then it can be both created and purchased (or given) as an NFT, meaning you can own a Tweet, an X-ray, a Taco Bell GIF, an NBA Top Shot clip, a CryptoPunk, a video of a rotating bear skeleton, an article, etc, etc, etc times infinity. As you can glean, the possibilities are basically endless.

NFTs are designed to give you something that can’t be copied: ownership of the work (although in some cases, the artist can still retain the copyright and reproduction rights, just like physical artwork),” Brown says. “To put it in terms of physical art collecting: anyone can buy a Monet print, but only one person can own the original.”

How Do NFTs Work?

Peer beyond the proverbial curtain and you’ll notice that the majority (though not all) of NFTs are supported by the Ethereum blockchain. Just a reminder: a blockchain is essentially a decentralised and incorruptible digital ledger that records all transactions so as to confirm exchanges and protect ownership of a cryptocurrency or an NFT, amongst other things. Bitcoin and Ethereum (to name just two out of the mind-numbing legion of cryptos) are both supported by their respective blockchains so as to secure ownership and enable safe transactions.

In order to give NFT art and other non-fungible tokens their digital signatures, Ethereum’s blockchain stores separate information than that of a traditional ETH coin. As a result, it’s able to confirm unique ownership over this one-of-a-kind entity. By extension, the NFT’s owner also has the ability to sell their non-fungible token somewhere down the road. Other blockchains are now emerging with similar capabilities, but the Ethereum blockchain remains king of the NFT.

How Do NFTs and Crypto Differ?

Both supported by blockchain technology, NFTs and crypto are otherwise as starkly different as say a rare painting and cold hard cash. Remember, NFTs are unique commodities whereas cryptocurrency is more analogous to something like stocks, precious metals, or…well…currency. Trading one Bitcoin for another is as pointless as swapping out equal amounts of gold, equal shares in the same company, or two $5 bills (on the presumption that one of those bills isn’t rare or collectible). By contrast, to trade two NFTs is to trade one completely unique entity for another. Even if both NFTs are similarly valued during the exchange, one could subsequently skyrocket in value whilst the other could plunge.

According to Brown, the increase in interest for NFTs has been spurred by scarcity and exclusivity. Like all collectibles, these factors have altered the way artworks are perceived and driven price points up.

“Rather than traditional digital artworks that people can easily download and store for free, NFTs have a signature that can be verified in the public ledger and therefore cannot be duplicated or edited,” the crypto and NFT expert says. “When people buy an NFT, they gain the rights to the unique token, but not always the artworks themselves. The ability to easily prove rarity and authenticity is a huge factor contributing to the rise of NFTs.”

An NFT from the Bored Ape Yacht Club Collection/Courtesy: Sotheby’s

What Are NFTs Used For?

When you purchase an NFT—whether it be a video, image, X-ray, meme, song, NFT artwork, digital sports card, or Tweet—you are the single owner of that particular property. Where you take your property or how you use it can vary. For instance, you can buy an ultra-thin, ultra-HD screen and display your rotating collection of NFTs on a designated wall. Or you can project the NFT as an augmented reality hologram (should you have the means). Or you can put it as the home screen background on your smartphone. Or you can simply hold onto it (or should we say hodl) and then sell when the time is right.

Currently, most NFTs are reproducible the way one might reproduce a rare painting, but with a key difference: the reproduction of a Van Gogh is usually going to come off as an imitation, whereas a digital image or video can be replicated without variance. Nevertheless, only one person (or group of people) can truly own the original. To be clear, this doesn’t automatically mean they own the copyright, though an NFT can be sold as intellectual property. A creator can also sell the publishing royalties as an investment property without selling the actual copyright, as Dave Burd (aka Lil’ Dicky) recently did with the track “Save Dat Money.

Should someone purchase an NFT complete with copyright, they might be able to licence it for use in other mediums like movies, shows, games, and merchandising. Even on a smaller scale, it’s not so hard to fathom a scenario where someone can own the copyright to a meme (which are technically copyrighted already), charging others a small fee every time they want to use it. Thanks to blockchain and crypto, paying that small fee could be as simple as clicking a button.

But let’s run even wilder with our imaginations. Picture a future in which people convene in a virtual world and even own property in that world (think “Ready Player One” or something of the like). In this scenario, NFT ownership might take on even more of an exclusive allure. You can welcome someone into your digital home and present them with your exclusive digital property, the ownership of which is supported and protected by the blockchain. Even without full immersion, perhaps you can own the rights to certain avatars or digital properties in role-playing games.

To some, this all might sound a bit silly. Then again, if you were around in the 1980s, people might have thought you were silly for buying the first Air Jordans or a sealed copy of Super Mario Bros. and then stowing it away as an investment property. Meanwhile, have you seen what those very same products now go for on the auction block?

Sneakers and video games are not true one-of-a-kind properties, but the analogy still holds when we take it into the realm of NFTs. What currently seems like a wild investment could one day prove itself quite sound. This may help explain the CryptoPunks craze or the USD$69 million sale of Beeple artwork, amongst other things. Should the NFT trend continue, these early examples could end up being the safest bets. Of course, one can also assume that plenty of NFTs will lose their value over time.

The Future of NFTs

While some brands have jumped on the NFT bandwagon just to be involved, others are using NFTs as a way to innovate and get a foothold in the ever-growing crypto industry. In fact, in recent times, some of the biggest platforms and brands in the world are getting involed.

In September 2021, one of the most popular NFT collections, CryptoPunk 7610, was bought by Visa for roughly USD$150,000, in an effort to “have a seat at the table as the crypto economy evolves”. Visa is one of the highest-profile examples to date of a brand embedding itself into the digital community in a way that until now has been somewhat elusive.

Other companies such as Coca-Cola are using NFTs as a way to monetise on the culture. The company released a range of NFTs earlier this year, which it claimed was its way to participate in and learn from the emerging space,” Brown says. Some companies are using NFTs to create a whole new income stream to support the traditional and established music community, while others are looking to revolutionise the gaming industry altogether.

Importantly, Brown notes that NFTs are now creating opportunities for new business models that didn’t exist before. Artists can attach stipulations to an NFT to ensure they get some of the proceeds every time it gets resold and also removes the fear of counterfeiting.

Brown says that beyond the digital world, some companies are currently planning different ways NFTs can benefit the ‘real-world’. These include:

- Event tickets: Event organisers will sell NFTs, instead of tickets. The purchaser can resell them if they choose and organisers can be confident their NFT won’t be counterfeited.

- Asset ownership documentation: Titles to homes and vehicles will be tied to NFTs. This will allow sales processes to be streamlined since title searches can be simplified.

- Cybersecurity: Blockchain security is not 100% invulnerable to crypto-criminals, but assets secured in that way aren’t the option they go for first. To the extent that anyone’s important assets are locked within an NFT will provide them with a higher level of security.

The Art World’s Reaction

Needless to say, NFTs have elicited a mixed reaction, particularly from the traditional art world. While some artists have questioned the validity and creativity behind the medium, while others are embracing the new digital gallery.

“There are already heaps of world-famous traditional artists creating and selling NFTs, that wouldn’t have typically been considered digital formats prior to their emergence,” Brown says. “However, not all are sold on the idea as of now, especially those that are considered more “old school”, and are fearful for what technology will mean for their craft.”

According to the market expert, it’s important to consider their perspective; fine art is embedded in a culture of exclusivity and prestige, stemming from the skill, materials and human labour that goes into creating physical works.

“In the future, this might change, and we might see physical art evolve with artists no longer having to rely on galleries and museums as the sole medium through which they can sell their work. This shift in perspective has allowed for greater freedom and choice in the artists’ work, while also bringing in new audiences and a stream of traditional artists to NFTs,” he says.

“Even graffiti artists are making a splash with NFTs. Local Melbourne artist LushSux is reported to have cashed in at least $500,000 in NFTs, with some of his prolific works listed for $100,000 on one gallery he’s dubbed Lushsux’s Lambo Fund.”

How to Buy NFTs

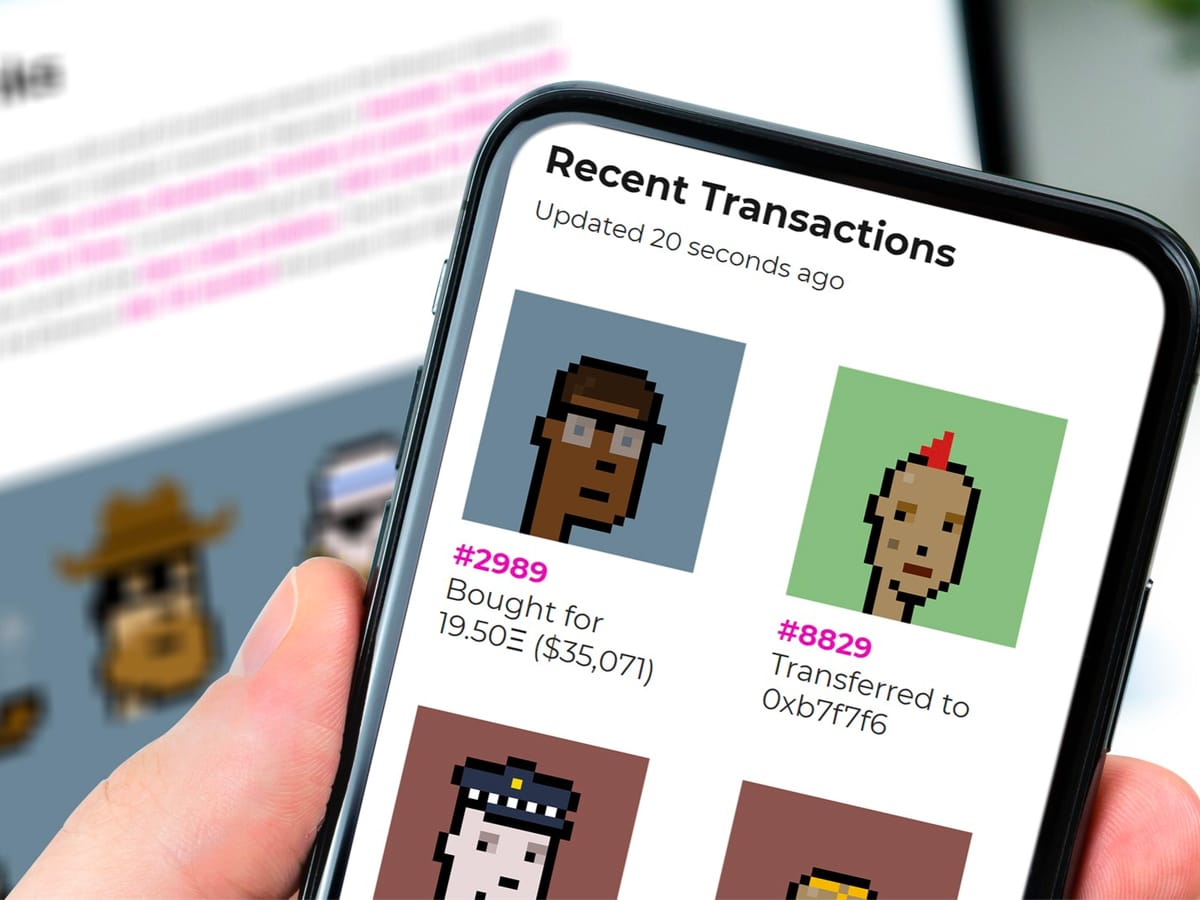

You can currently purchase NFTs through a number of platforms, many of which specialise in some sort of niche like trading cards, artwork, memes, and so on. Others are more general in scope, straddling a full range of categories. Traditional auction houses, in-app purchase games, and art galleries are also bringing non-fungible tokens into their wheelhouse.

Upon choosing a platform (or platforms), you’ll need to register an account and have a digital wallet before you can bid or buy. Make sure your wallet is filled with enough crypto (namely Ether) so that you’ll have the funds to complete your purchase.

Here’s a brief list of some popular NFT platforms:

- OpenSea

- Nifty Gateway

- Foundation

- VIV3

- Axie Marketplace

- Rarible

- SuperRare

Should You Buy NFTs?

We’re here to answer a question—what is an NFT?—meaning we’re not here to offer you investment advice (and for somewhat obvious reasons). With that disclaimer out of the way, we would add that there’s no harm in supporting NFT art for the same reasons that you’d support traditional art: because it nurtures creativity and growth. In this scenario, you wouldn’t buy NFT art as an investment, but because you actually like the image, video, song, meme, or whatever else and want to own it for yourself.

Further to that, some still speculate that the NFT craze is just a bubble stemming from increased online activity following the pandemic, while others believe it’s here to stay.

Right now, most NFTs are used to predominantly sell digital art and collectables, but in the future it’s expected that they could be used to tokenise any real world asset, from property to handbags, making ownership of assets transparent and scrupulous,” Brown says.

“Will the future be filled with cat GIFs being sold off as NFTs for millions of dollars? It’s hard to say, but the growing trend is proof of the accelerated interest in the crypto and blockchain realm and its longevity in the years to come.”

You’ll also like:

11 Best Tattoo Artists & Shops in Sydney

Stock Investing 101 – What is an IPO?

General FAQs

According to CoinSpot market analysts, Ray Brown, the reason NFTs are expensive is down to scarcity and exclusivity. Rather than traditional digital artworks that people can easily download and store for free, NFTs have a signature that can be verified in the public ledger and therefore cannot be duplicated or edited.

A non-fungible token (NFT) is a unique digital asset that represents ownership of real-world items like art, video clips, music, and many other things. These toked use the same blockchain technology that powers cryptocurrencies, but they are not a currency.

At the time of publication, Everydays: The First 5000 Days is the most expensive NFT ever sold at USD$69.3 Million.

Comments

We love hearing from you. or to leave a comment.