Published:

Readtime: 7 min

Every product is carefully selected by our editors and experts. If you buy from a link, we may earn a commission. Learn more. For more information on how we test products, click here.

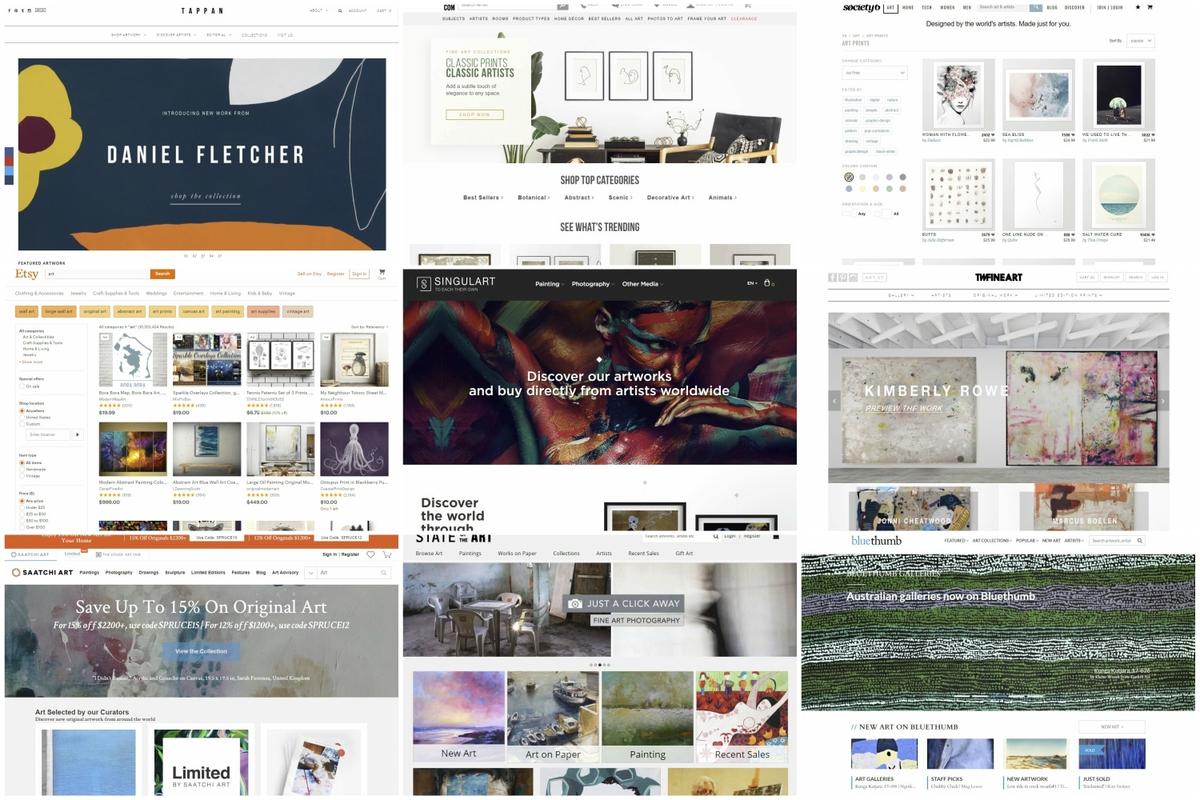

There comes a time in a person’s life when you must take down the action movie posters and hang up some quality artwork. This should represent a meeting ground between personal expression and interior design, speaking to you personally but also flowing with its surroundings. Of course, this all begs the question of where you find said artwork. You can check out the nearest art galleries in your city as a start, but we prefer shopping online these days. or you can find the best places to buy art online, putting thousands of artists and works at your fingertips. We’ve put our favourite art-buying websites to save you the trouble of embarking down the wrong path. Here is a list of the best places to buy art online.

Best Places to Buy Art Online at a Glance

Highlights from our list include the following options:

- Best overall: Fine Art America

- For original works: TWFINEART

- For rare pieces: 1xRun

- For prints: Society6

Now you’ve read our favourites, let’s check out the complete list.

RELATED: 20 Best Home Gifts – Unique Presents for Homeowners.

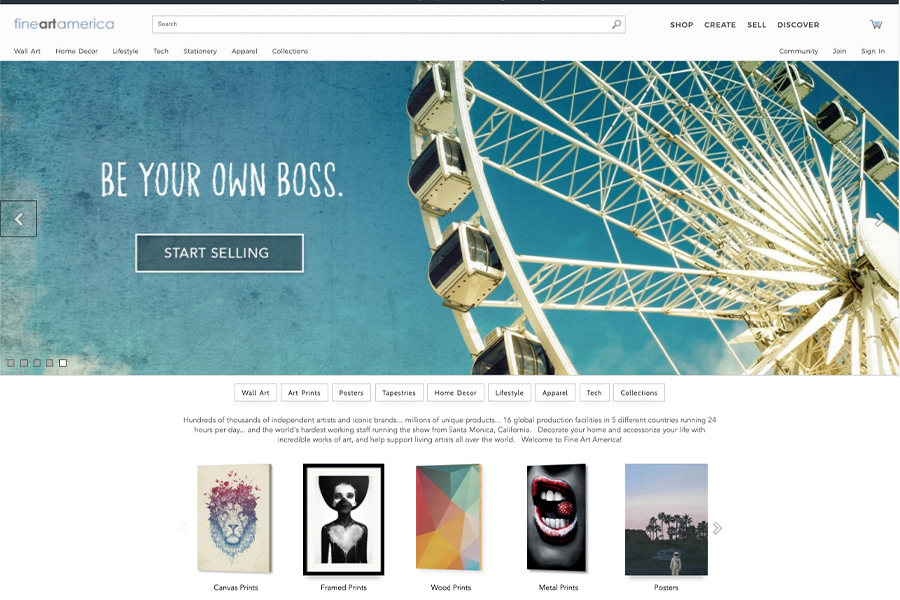

1. Fine Art America

As the world’s largest art marketplace and print-on-demand technology company, Fine Art America is a no-brainer regarding the best places to buy art online. Since 2006, the company has allowed artists, photographers, graphic designers and illustrators to share their work with the world. Better still, Fine Art America allows the artists to set their own prices for print-on-demand products before producing them at one of the brand’s 16 global production facilities. With over 500,000 independent artists earning an income through selling their art on its platform, Fine Art America should be top of your list on places to buy art online.

Based: Santa Monica, California, United States

Founded: 2006

Style: Print, Photography, Fine art, Graphic design

Shipping: Global

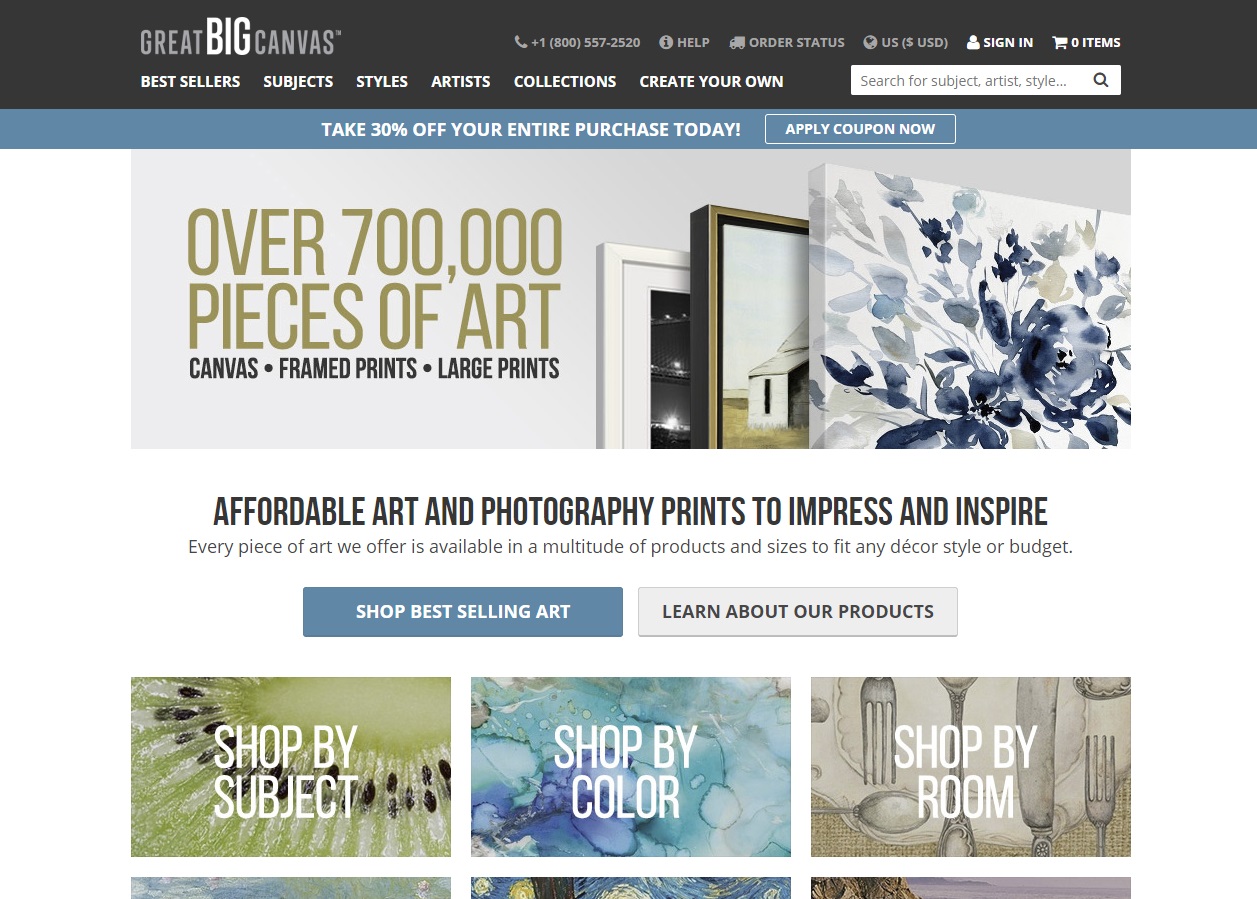

2. Great Big Canvas

From Great Big Canvas, classic artists like Claude Monet and Paul Cezanne are next to the hottest contemporary names. The site goes big on customisation, meaning you can adjust everything from the frame to the size and the canvas style. Meanwhile, their customer service is second to none.

Based: Raleigh, North Carolina, United States

Founded: 2006

Style: Classic, Fine art, Contemporary

Shipping: Global

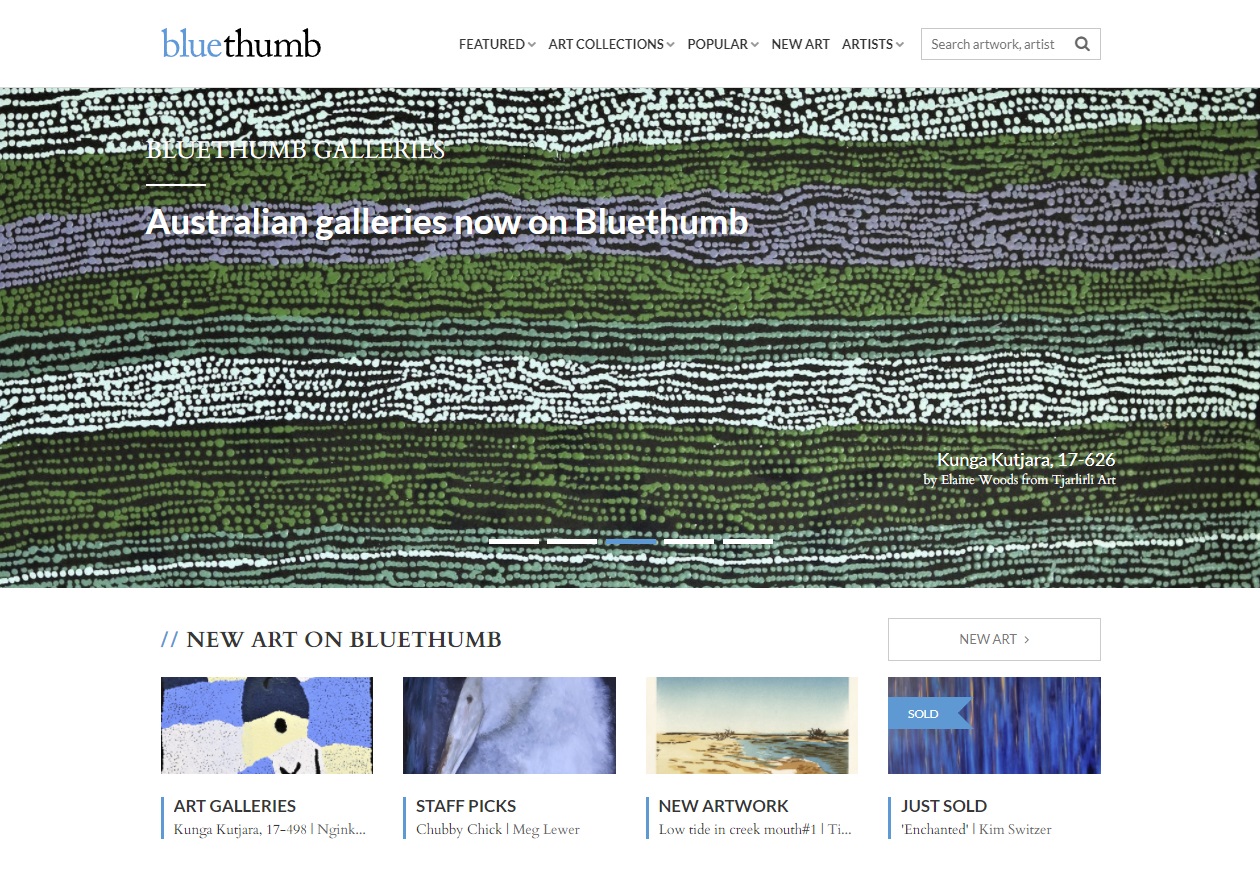

3. Bluethumb

Australia’s largest digital art marketplace and one of the best places to buy art online, Bluethumb is a living community that promises to put unforgettable work in your hands and on your wall. They offer various prices and styles and feature established and emerging artists.

Based: Melbourne, Victoria, Australia

Founded: 2009

Style: Fine art

Shipping: Global

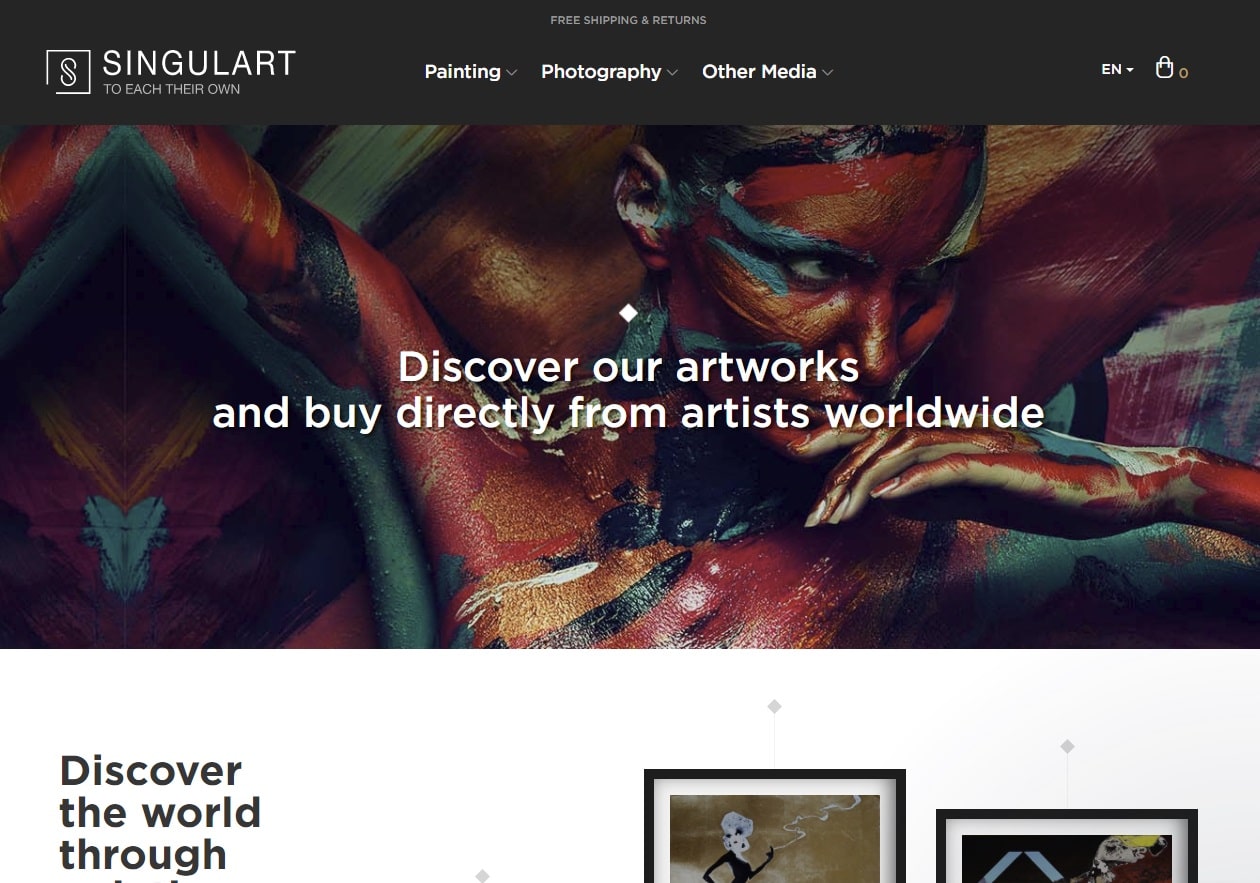

4. SINGULART

The Singulart founders scour the world for the best in art and bring the results directly to their online community of enthusiasts and collectors. In a welcomed move toward complete transparency, they keep the artists themselves squarely in the loop at every stage of the process.

Based: Paris, France

Founded: 2017

Founders: Vera Kempf, Brice Lecompte, Denis Fayolle

Style: Fine art

Shipping: Global

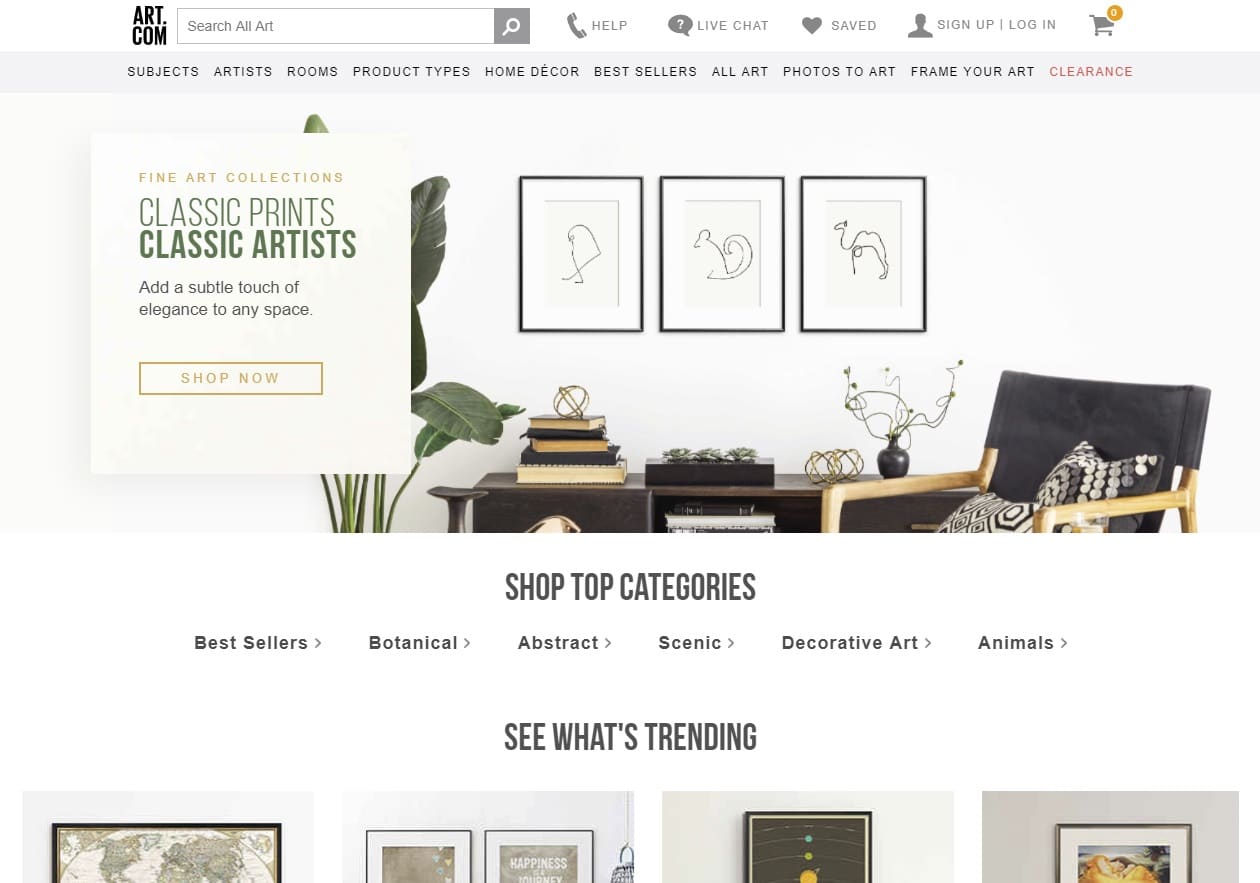

5. Art.com

The name pretty much says it all. Thankfully, Art.com’s operation does far more than merely capitalising on a valuable domain name. Indeed, this is one of the easiest and best places to buy art online.

Based: Emeryville, California, United States

Founded: 1998

Style: Fine art

Shipping: Global

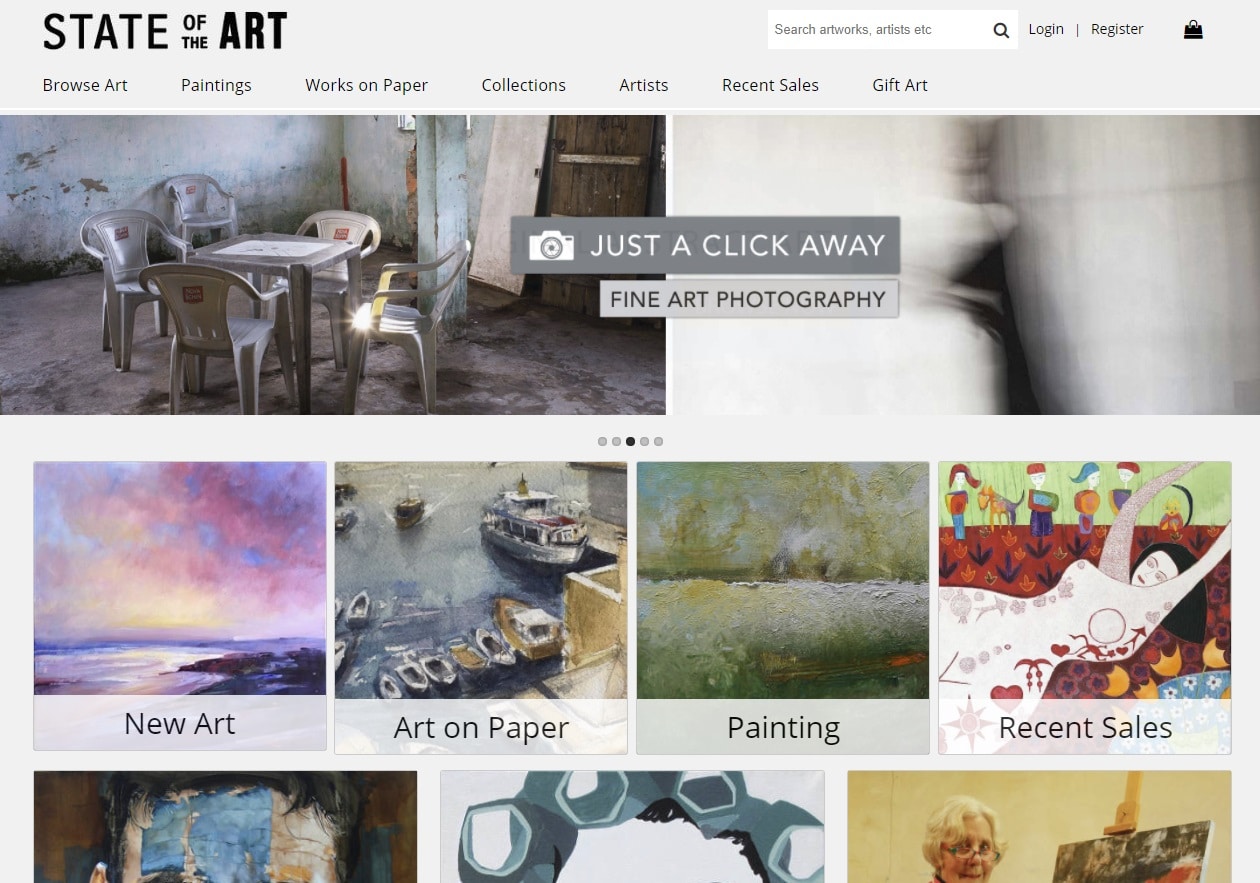

6. State of the Art Gallery

This online gallery and marketplace started in South Africa and has recently expanded to Australia. They review local submissions one at a time and select what they think has the most potential. Think of it as a traditional high-end gallery exponentially diversified by the power of the Internet.

Based: Melbourne, Victoria, Australia

Founded: 2014

Founder: Victoria McGregor

Style: Fine art

Shipping: Global

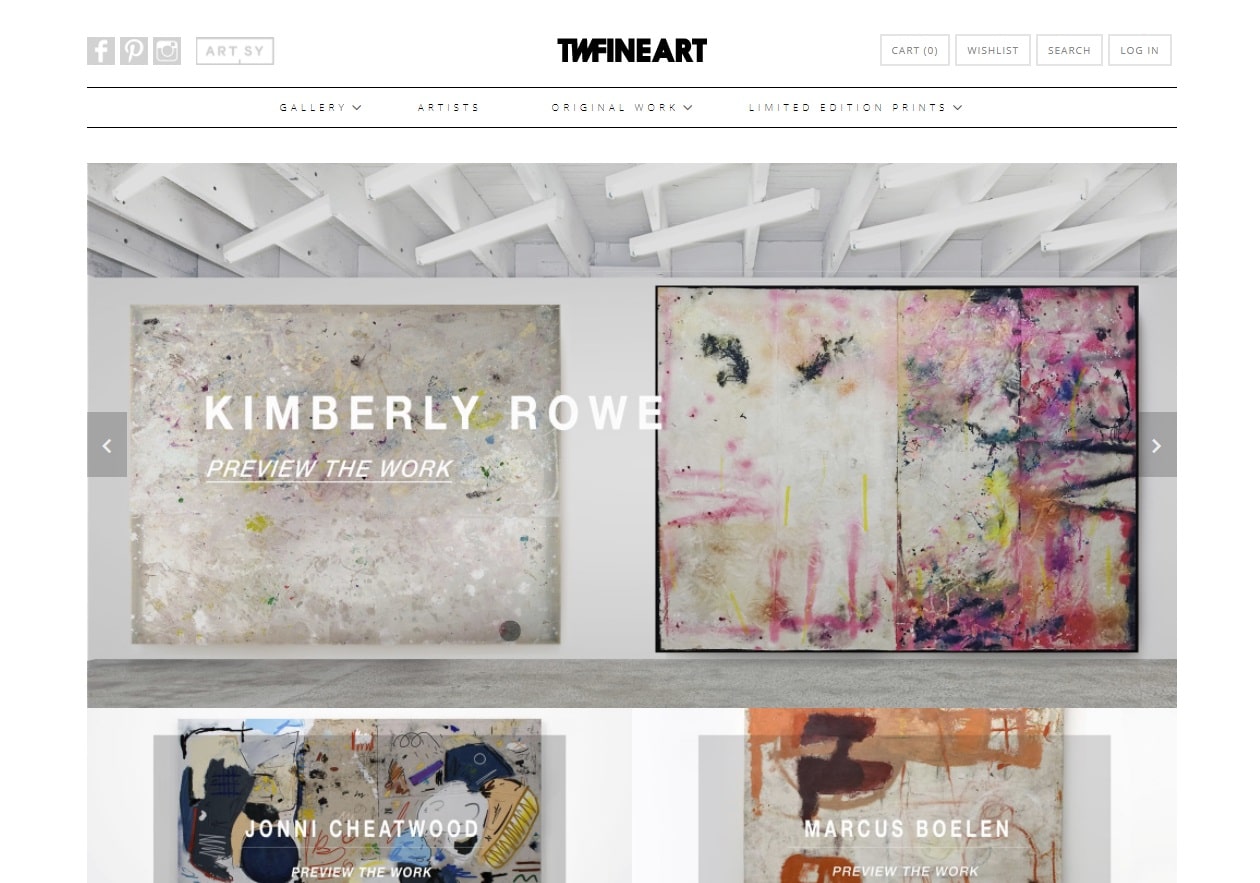

7. TWFINEART

Brisbane’s foremost art gallery is also one of the best places to buy art online. Shop among their range of prints and original works, and rest assured you’ll be exposed to some of the hottest artists on the international stage.

Based: Brisbane, Queensland, Australia

Style: Fine art, Graphic design

Shipping: Global

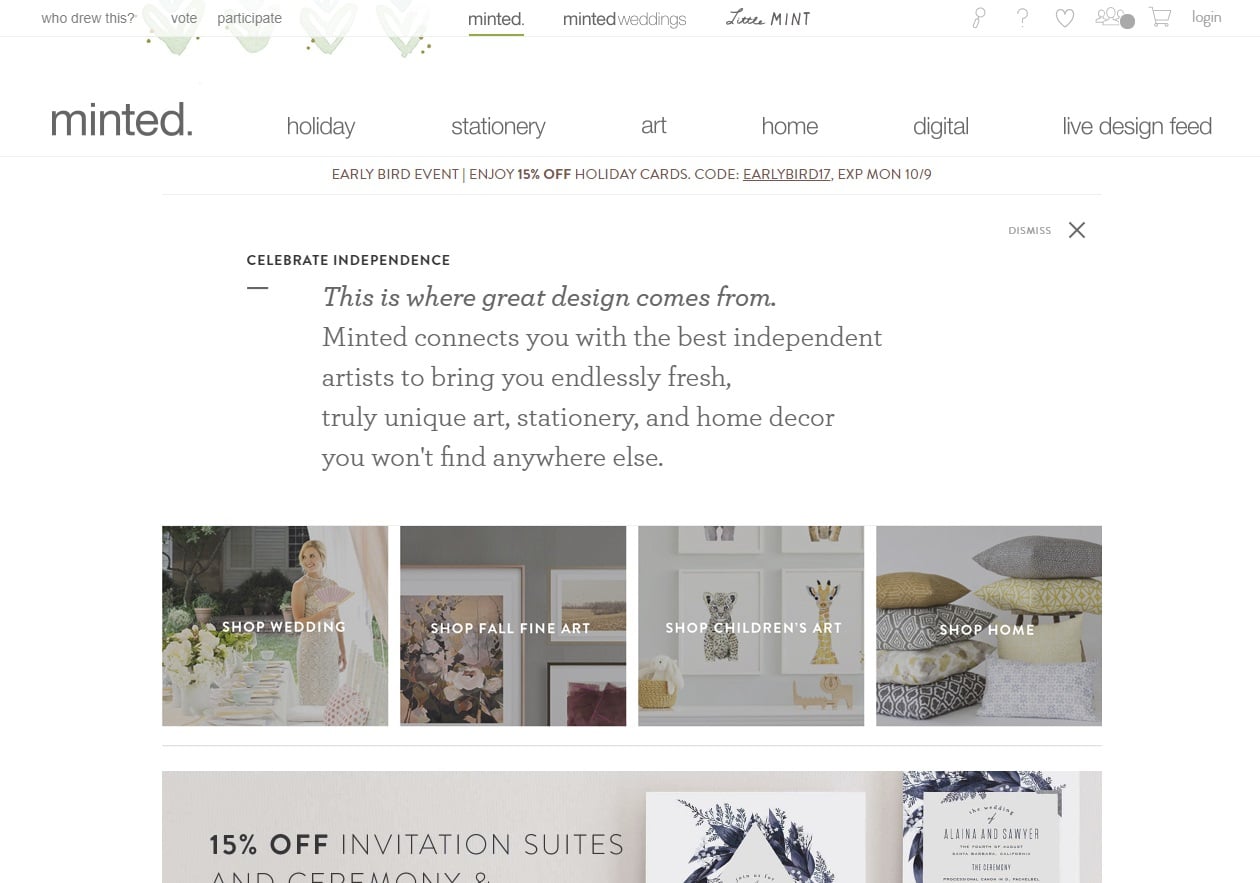

8. Minted

Some retailers adapted to the digital tide while others were created by it. Minted is a perfect example of the latter. The online marketplace is home to many creatives who offer up their work for the public to vote on. Winning entries are then produced in various forms, including wall art and wedding invitations, giving you a great taste of affordable art.

Based: San Francisco, California, United States

Founded: 2007

Founder: Miriam Naficy

Style: Fine art, Graphic design

Shipping: Global

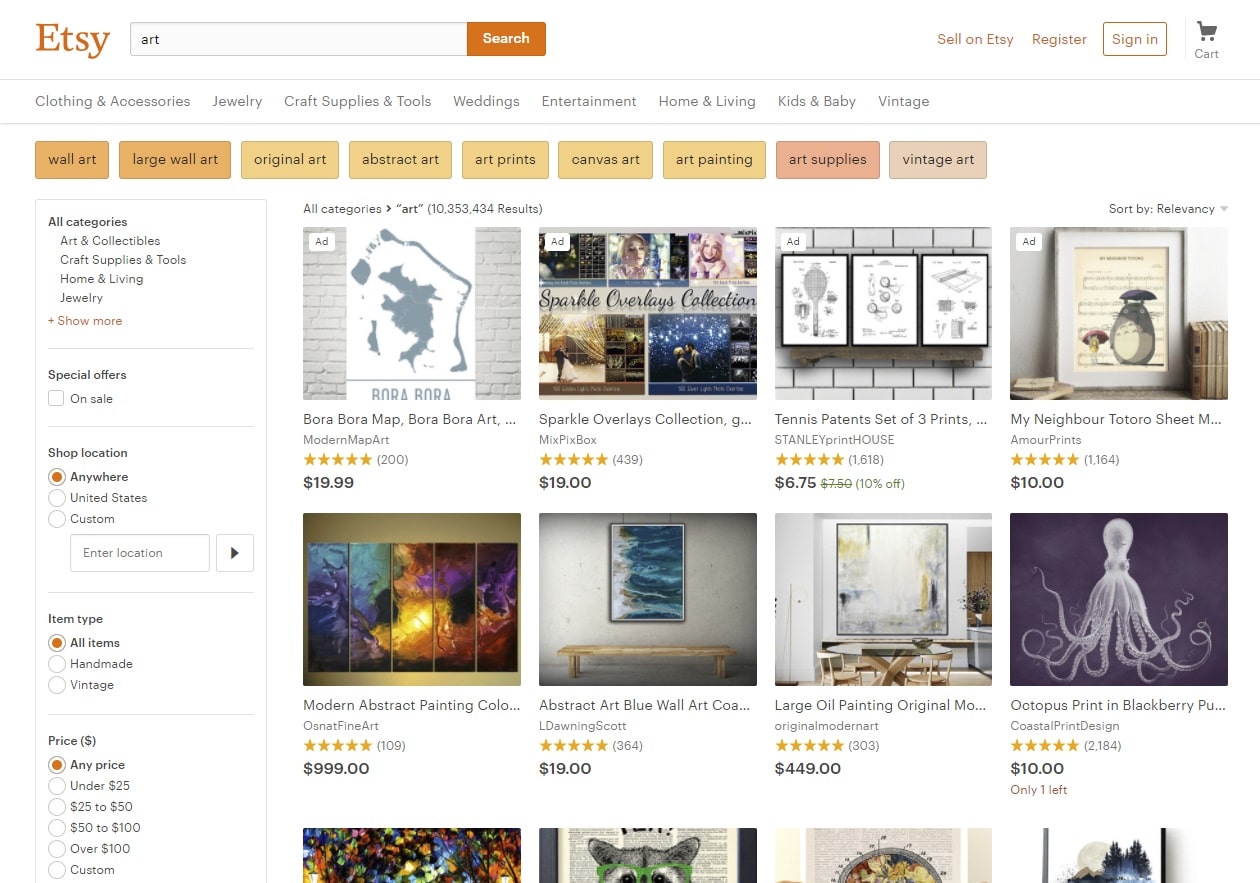

9. Etsy

Like an artisanal cousin to eBay and Amazon, Etsy is ideal for artists and galleries to reach out directly to collectors. Naturally, the affordable art selection is virtually endless. To call Etsy one of the best places to buy art online would be more or less redundant.

Founded: 2005

Style: Direct-to-consumer, Affordable art

Shipping: Global

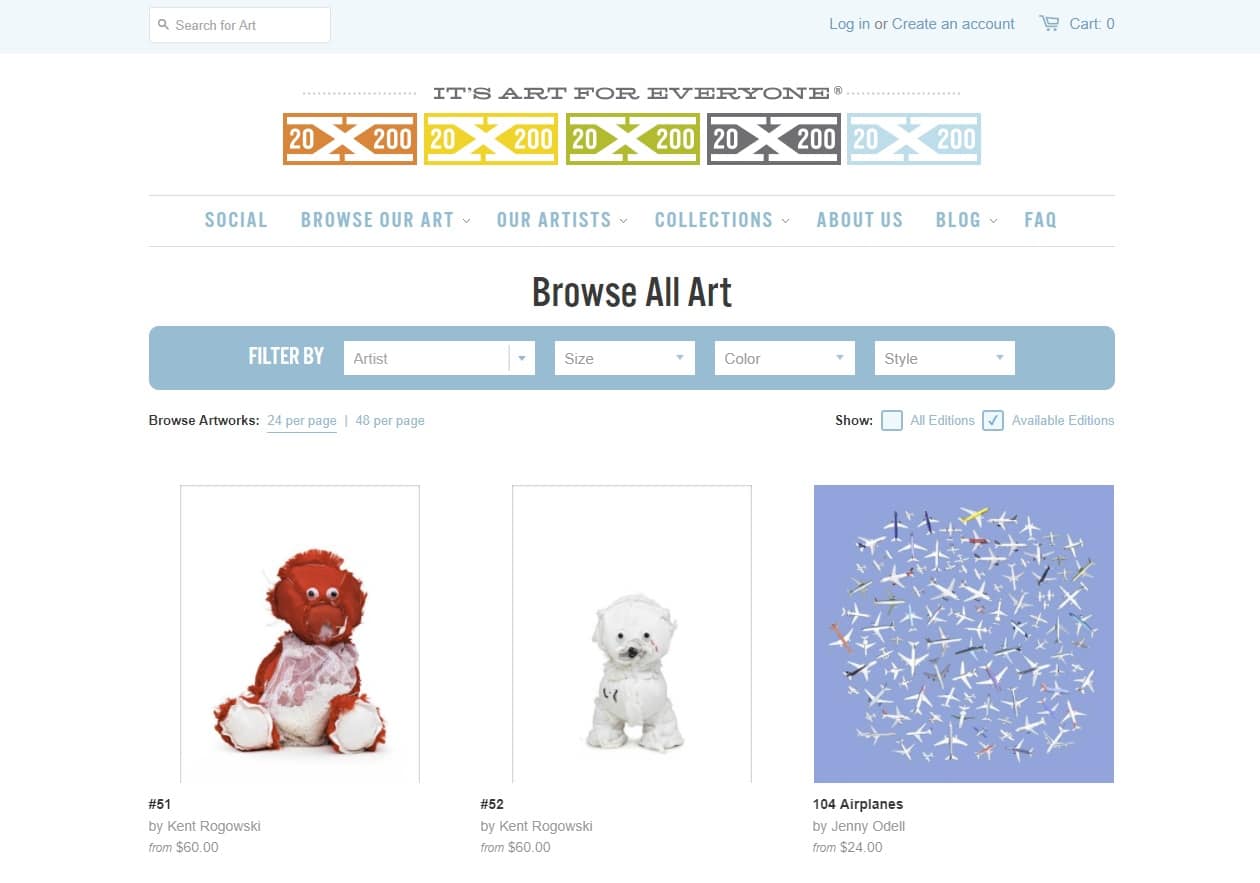

10. 20×200

Since 2007, 20 x 200 has lived by one core motto: “Art for Everyone.” Such a warm welcome practically obliges people from all walks of life to partake, and the site offers a full spectrum of styles and prices to ensure no one gets left behind.

Founded: 2007

Style: Fine art, Affordable art

Shipping: Global

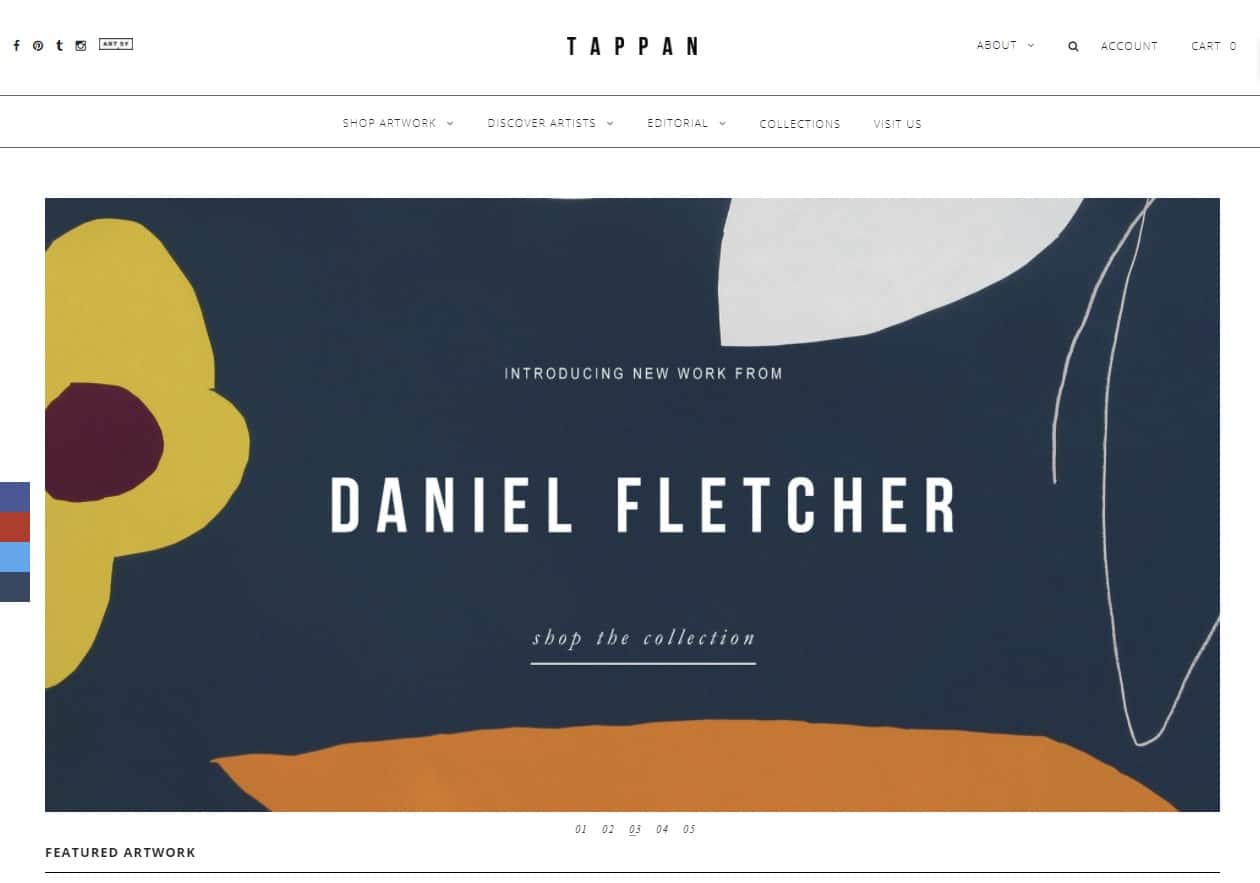

11. Tappan

In art, it’s all about the next big thing, and Tappan has its fingers on the world’s pulse. Come here to buy the best emerging and affordable art before it costs ten times as much.

Based: Los Angeles, California, United States

Founded: 2012

Style: Fine art, Graphic design, Affordable art

Shipping: Global

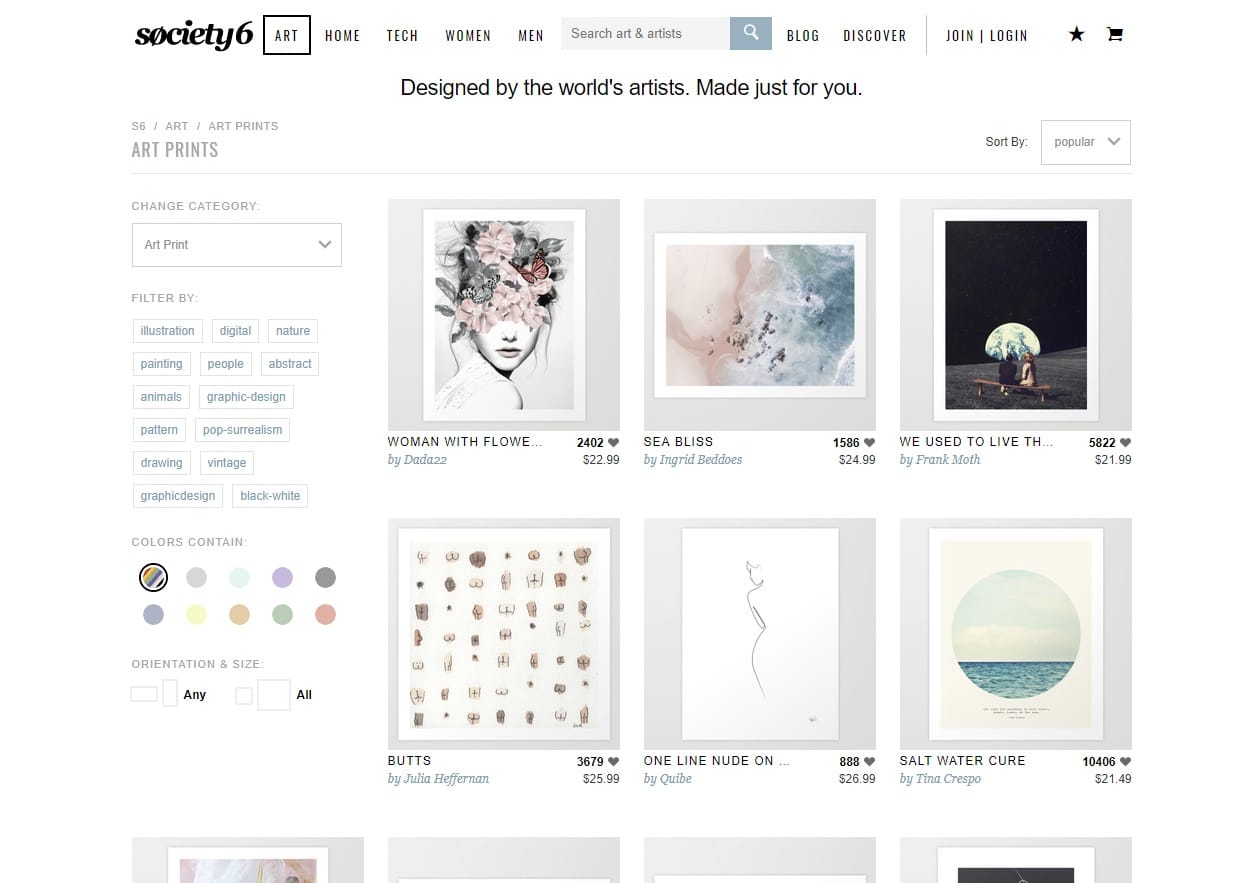

12. Society6

Buying great art doesn’t have to mean breaking the bank. In addition to the latest gadgets and apparel, online retailer Society6 offers a completely affordable range of brilliant art prints. Find the ones that speak to you, and let them enrich your life and your decor.

Based: Santa Monica, California, United States

Founded: 2009

Style: Fine art, Graffiti, Graphic design

Shipping: Global

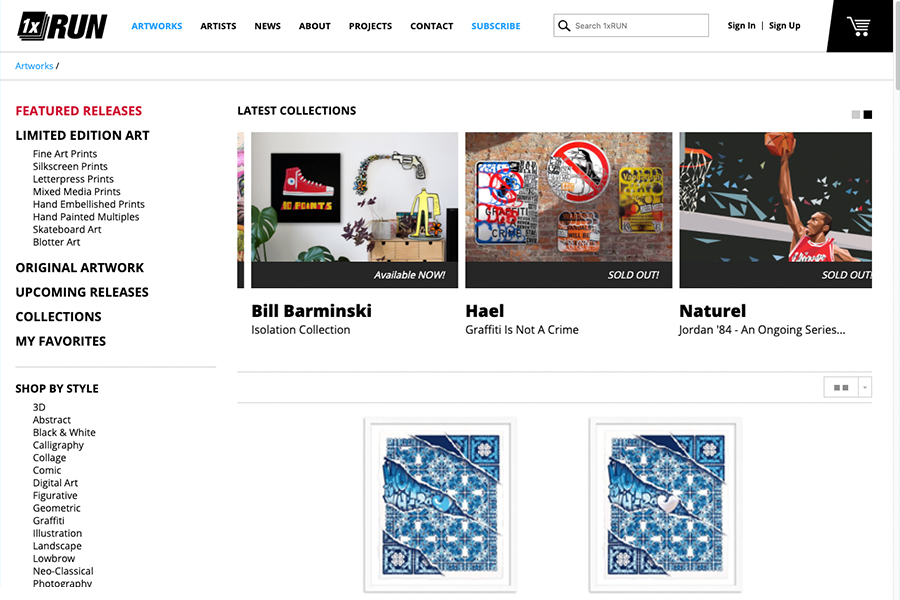

13. 1xRun (One Times Run)

Working exclusively on limited-run pieces, 1xRun is the premier online art dealer for rare or one-of-a-kind works. Most pieces have a graffiti or streetwear vibe, but you can also score some pretty handy pieces from photographers and traditional modes.

Based: Detroit, Michigan, United States

Founded: 2010

Style: Graffiti, graphic design prints

Shipping: Global

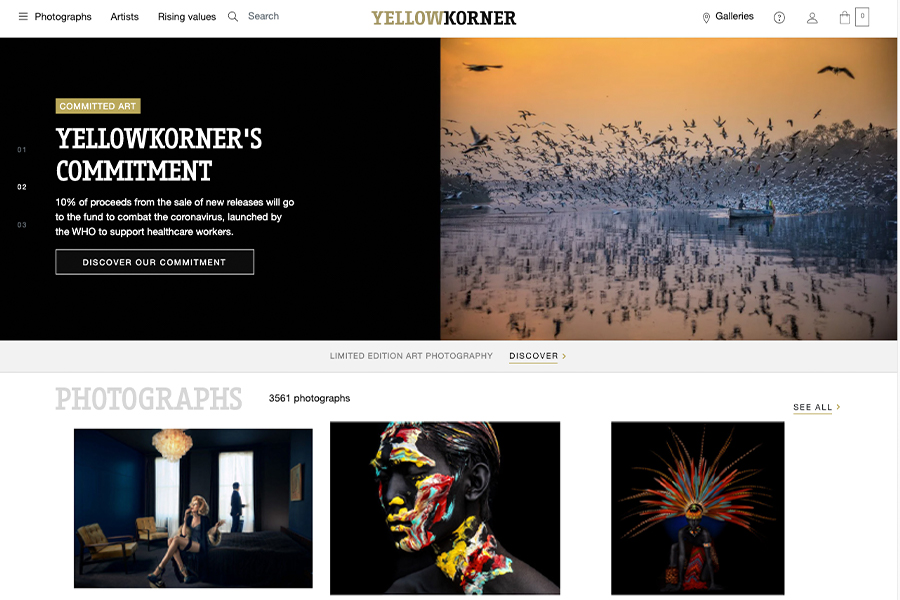

14. YellowKorner

This photography-based online art dealer is for the true purist. The artworks start at around $200, but prices jump for the more recognised producers.

Based: Detroit, Michigan, United States

Founded: 2006

Style: Photography

Shipping: Global

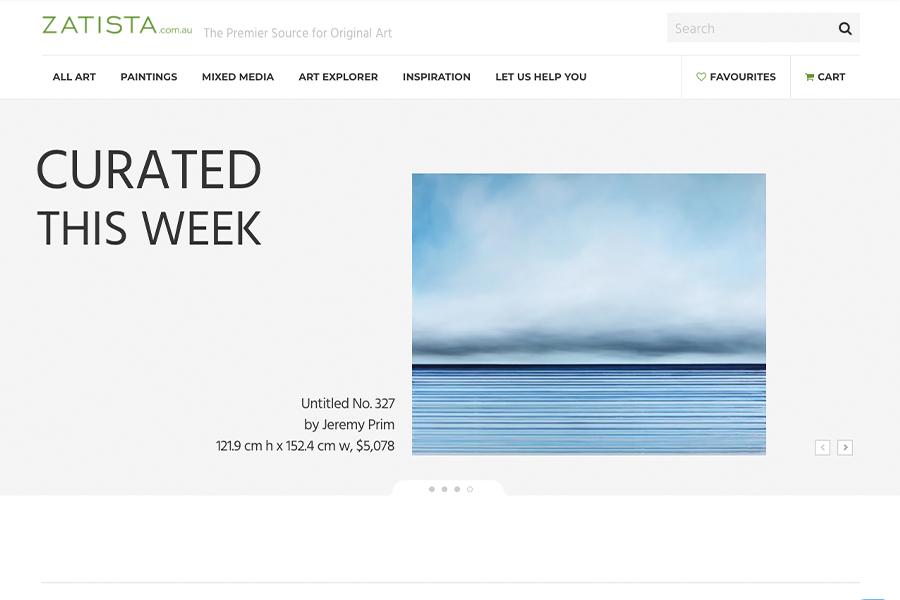

15. Zatista

If you are a fan of fine art and looking for a place to buy art online, Zatista might be your best bet. The curated collection offers a range of artworks from established and emerging artists perfect for home decorators, designers, and art lovers alike.

Based: Philadelphia, Pennsylvania, United States

Founded: 2006

Style: Fine art

Shipping: Global

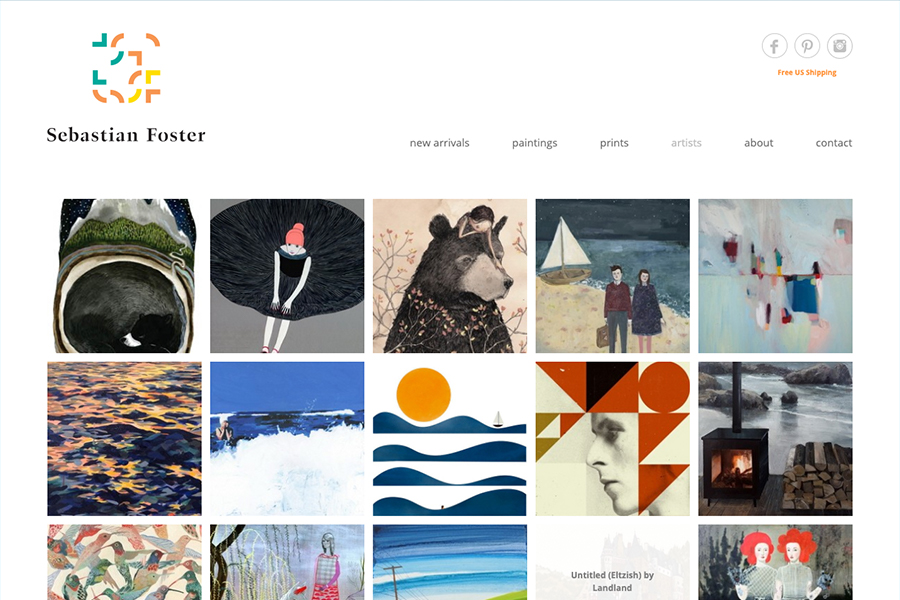

16. Sebastian Foster

Based in Austin, Texas, Sebastian Foster is the brainchild of founder Lad and his good friend and artist Matte Stephens. After nearly 10 years in business, the online operation has emerged as one of the best places to buy art online. The collection features artists from over 20 US states and 11 countries.

Based: Austin, Texas, United States

Founder: Lad

Style: Modern, Fine art

Shipping: Global

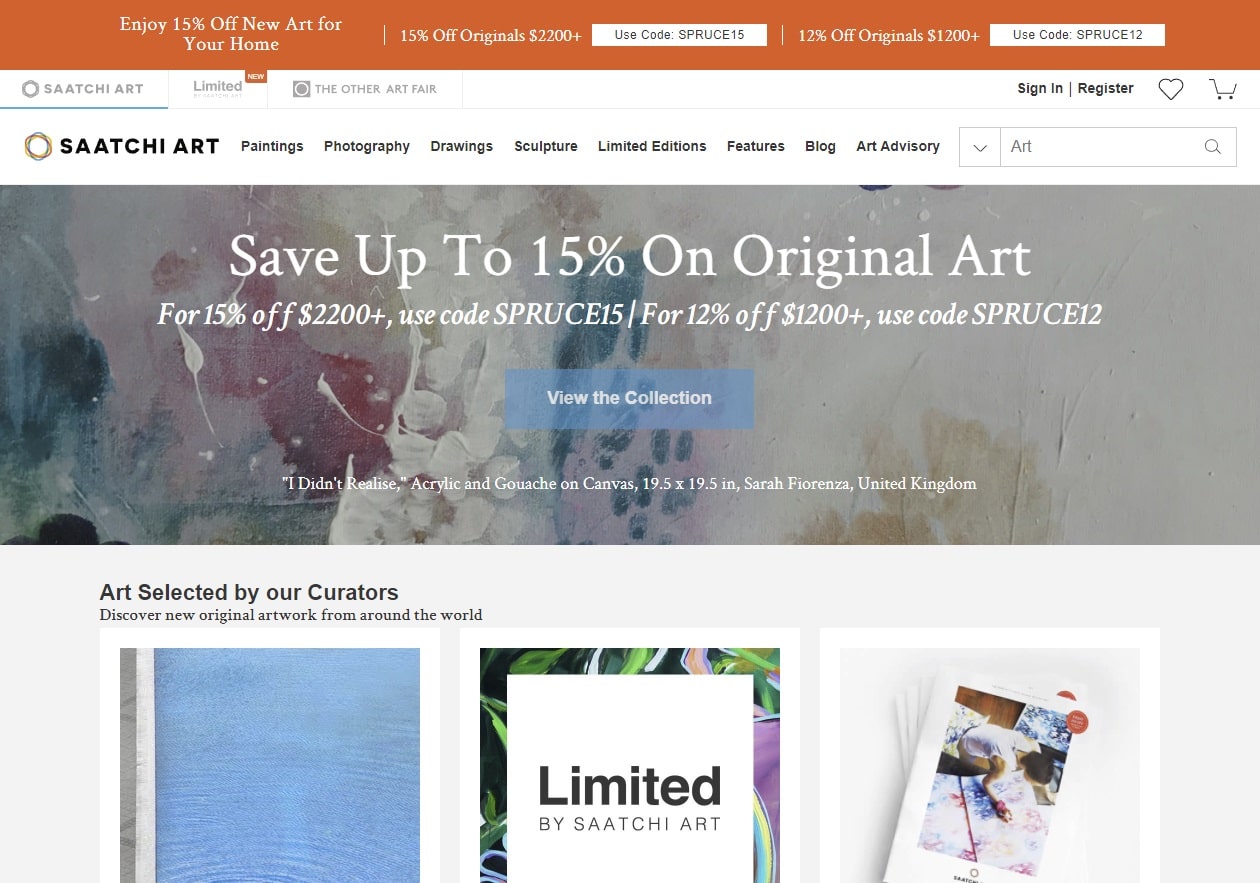

17. Saatchi Art

Los Angeles-based Saatchi Art makes shopping for drawings, paintings, sculptures and photographs a breeze through a tremendously approachable layout. Their team of curators find the latest and greatest artists from around the world and brings them straight to your computer screen and then to your door. Expect a full range of styles, prices, in-depth articles, and videos.

Based: Santa Monica, California, United States

Founded: 2010

Style: Classic, Fine art, Contemporary

Shipping: Global

You’ll also like:

Comments

We love hearing from you. or to leave a comment.