Published:

Readtime: 9 min

Every product is carefully selected by our editors and experts. If you buy from a link, we may earn a commission. Learn more. For more information on how we test products, click here.

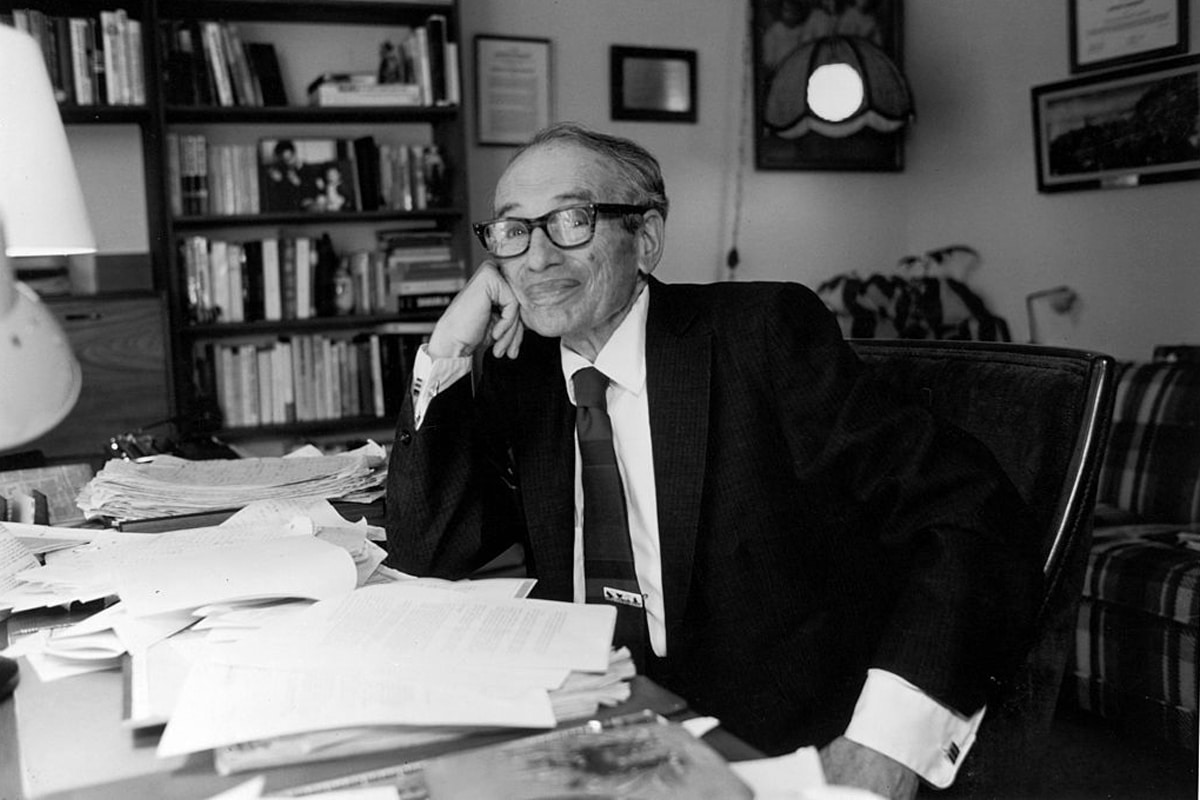

If you want to learn how to trade with the big boys, you’ve got to understand how the big boys trade, and there’s none bigger than The Oracle of Omaha. With a net worth of over USD$100 billion, Berkshire Hathaway CEO and chairman Warren Buffett has an investment portfolio that few in history could match. A multi-time rich-lister, the businessman and philanthropist is known for being one of the world’s most savvy finance gurus. In fact, Warren Buffett’s investment strategy has for long been heralded as the thing of legend, an innate ability to pick winners based off nothing but a gut feeling. In reality, however, his approach to stocks and indices is far more calculated and thorough. Best of all, it can be replicated.

You may also like:

How to Buy Stocks: A Guide to Investing for Beginners

Who is Warren Buffett?

Born in Omaha in 1930, Warren Buffett showed promise in academics at a young age. Developing an interest in the business world, he started his education at the Wharton School at the University of Pennsylvania before moving back to go to the University of Nebraska, where he received an undergraduate degree in business administration. Buffett later went to the Columbia Business School where he earned his graduate degree in economics.

After beginning his career as an investment salesperson in the early 1950s, he moved on to form Buffett Associates in 1956. Less than 10 years later, he was in charge of Berkshire Hathaway. In the decades that passed, Buffett amassed an incredible fortune thanks to a mixture of savvy investments, such as ABC and lucrative consulting deals. In 2008, he was named the Richest Man in the World, however, his philanthropic efforts saw him slip down the ranks in recent years, giving away a vast majority of his wealth.

Benjamin Graham School of Value Investing

When it comes to unlocking how Warren Buffett made his money, the blueprint is more simple than you’d think. “Warren Buffett follows the Benjamin Graham school of value investing, which looks for stocks or assets whose prices are unjustifiably low based on their intrinsic worth,” Robert Francis, MD of global multi-asset investment platform eToro tells Man of Many. “Rather than focus on supply and demand intricacies of the stock market, Buffett looks at companies as a whole. Some of the factors Buffett considers are company performance, company debt, and profit margins.”

The Benjamin Graham strategy, created by the British-born American economist, professor and investor of the same name, allows Buffett to better predict the influx of wealth, business and growth a company stands to receive, and has been a major component of the Oracle’s continued success. But that isn’t to say he hasn’t changed things up over time. Francis reveals that Buffett’s investment style has changed after he met investor turned vice chairman of Berkshire Hathaway, Charlie Munger. Charlie convinced him that it is better to buy a good stock at a fair price/value, than to buy a stock just because it was cheap, such as Apple. Its PE ratio was well below the average PE ratio of the Dow Jones and NASDAQ index when he started accumulating.”

How it Works

As an investor, Buffett isn’t concerned with the supply and demand intricacies of the stock market. Instead, he looks at each company as a whole, so he chooses stocks solely based on their overall potential as a company. It’s a long-term strategy, see while he’s not after capital gain, his ownership in quality companies makes the prospect of generating earnings far easier. Rather than targeting companies that may receive market recognition in the future, he looks for how well that company can make money as a business.

“While not all investors will side with Benjamin Graham’s investing strategy, it can be beneficial for those who opt to. Value investing can provide substantial profits once the market inevitably re-evaluates the stock and ups its price to fair value. It also provides protection on the downside if things don’t work out as planned and the business falters,” Francis explains.

Benjamin Graham also believes in the idea of expecting volatility and profiting from it. “He illustrated this with the analogy of “Mr. Market,” the imaginary business partner of each and every investor,” Francis says. “Mr. Market offers investors a daily price quote at which he would either buy an investor out or sell his share of the business. Sometimes, he will be excited about the prospects for the business and quote a high price. Other times, he is down about the business’s prospects and quotes a low price.”

Because the stock market has these same emotions, Francis says the lesson here is that investors shouldn’t let Mr. Market’s views dictate their own emotions, or worse, lead them in their investment decisions. Instead, investors should form their own estimates of the business’s value based on a sound and rational examination of the facts. That doesn’t negate the fact that markets are consistently evolving and fluid in nature, which does beg the question. why has Buffett’s investment strategy stood the test of time?

Simply, because his advice is timeless,” Francis says. Known as the father of security analysis and value investing, Benjamin Graham’s two books “Security Analysis” and “The Intelligent Investor” were both released before 1950 and are regarded as two of the most famous investing books. Graham’s timeless principles provide a map that all value investors can follow to stock market success.”

How to Invest like Warren Buffett

With that in mind, the eToro MD and investing specialist outlined how to invest like Warren Buffett, using his favoured Benjamin Graham strategy. Here are his tips for following the investment plan.

1. Ignore Daily Moves

Warren Buffett and Benjamin Graham don’t pay much attention to the daily ups and downs of the stock market. Instead they opt to understand price versus value, choosing to invest in companies based on the underlying value of the companies, looking at indicators like revenue, potential growth, assets and strategic direction.

2. Find Good Companies

Warren Buffet is renowned for finding the right company at the right price, and has been incredibly successful at avoiding what’s known as ‘value traps’. Value traps happen when investors think they are getting a stock at a discounted price, but in reality, the business has a fundamental flaw that significantly reduces its intrinsic value. By focusing on quality instead of hype, Buffett is able to avoid the allure of inexpensive stocks that deserve to be deeply discounted.

3. Invest in Passions

Warren Buffett famously said “never invest in a business you cannot understand”. This doesn’t mean that investors need to be an expert in a company, but at least be able to understand what they do, how they’ve been performing and be well informed about the industry it finds itself in.

Investors should always keep up to date and read the news on their favourite companies before making an investment to understand the ins and outs of the business and whether they have growth potential before jumping in.

4. Adopt a Long-Term Investment Strategy

Warren Buffett adopts a long-term investment strategy, so once he buys shares, he rarely sells them. If investors want to invest like Buffett, it’s wise to consider a long term mindset, and not worry too heavily about what a company or stock is doing in the short term.

Utilising Other Strategies

While Buffet’s investment strategy has proven to be successful over a long period, it’s not the only long-term solution. According to Francis, there are two other strategies that can be easily replicated.

- Dollar-Cost Averaging – Dollar-cost averaging is achieved by buying equal dollar amounts of investments at regular intervals. It takes advantage of dips in the price and means that an investor doesn’t have to be concerned about buying their entire position at the top of the market. Dollar-cost averaging is ideal for passive investors and alleviates them of the responsibility of choosing when and at what price to buy their positions.

- Building a Diversified Portfolio – A Diversified portfolio with a combination of stocks and assets, is also a great way to strike a balance between risk and reward, as various asset classes behave differently depending on economic conditions. This allows investors to spread their money across a number of assets and help them earn more stable investment returns overall.

Disclaimer: The advice provided on this website is general advice only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this advice you should consider the appropriateness of the advice, having regard to your own objectives, financial situation and needs. If any products are detailed on this website, you should obtain a Product Disclosure Statement relating to the products and consider its contents before making any decisions. Where quoted, past performance is not indicative of future performance. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information on this website is no substitute for financial advice.

General FAQs

Warren Buffett famously follows the Benjamin Graham school of value investing, which looks for securities whose prices are unjustifiably low based on their intrinsic worth.

According to the latest figures from CNBC, Berkshire Hathaway CEO and chairman Warren Buffett has a net worth of USD$100 billion as of 2021.

You may also like:

Trading App Superhero Launches US Shares for Booming Aussie Investor Market

This Fintech Startup is Going Bananas (And You Can Own a Slice)

What is a Recession and What Does It Mean for Aussies?

Comments

We love hearing from you. or to leave a comment.