Published:

Readtime: 11 min

Every product is carefully selected by our editors and experts. If you buy from a link, we may earn a commission. Learn more. For more information on how we test products, click here.

It’s the end of the financial year and the beginning of a new chapter in the Australian economic calendar, which can be a daunting period for some. While many of us are preparing our tax returns in the hopes of getting the most from the last 12 months, others are taking note of the new First Home Loan Deposit Scheme. With 10,000 new spots on offer from Wednesday, 1 July, there’s never been a more interesting time to buy your first home.

You’ll also like:

What Can I Claim on Tax? A Guide to Working From Home Tax Deductions

12 Mind Hacks for Productivity

A Beginner’s Guide to Meditation

Despite the updates, however, the process isn’t exactly simple. “Whether you’re starting out on your journey to become a homeowner or well advanced with your savings and plans, there are often times when things can feel confusing or even overwhelming which research shows can hold people back from getting their dream home,” David Smith, chief customer officer at Aussie says. “Saving for your deposit is not an easy task, but more than 7 in 10 first home buyers admit that they want to take advantage of the property market right now, they just don’t know how. First home buyers are also not clear on the range of options available to them, including the latest government schemes and grants which could help them accelerate their property purchase.”

According to Smith, five in six first home buyers want more guidance on the best way to reach their home-ownership goals. We spoke with the lending specialist to make sense of the updates and find out how to break into the market.

Tips for Buying Your First Home

Whether you have been thinking about breaking into the housing market for some time, or you just want to take advantage of the recent updates, there are some things you need to know. Here, Aussie chief customer officer David Smith reveals his 10 tips for buying your first home.

1. Start Saving Early

“Knowing how much you need to save for a home deposit can feel overwhelming as you may not have decided on what you’re looking for yet,” Smith reveals. “But one thing is clear, setting a savings goal early can make all the difference. It may seem obvious, but the sooner you start the higher your chances of putting yourself in a better position in the future.”

The Aussie specialist says that staying motivated to save can be one of the hardest parts of the process, so it pays to set realistic goals and build up your savings bit by bit. “This could be achieved by setting an amount to put aside each month. These small, regular wins can help you stay driven to reach your ultimate goal,” Smith says. “Having consistency in savings is also important to show lenders that you may be a good candidate for a loan, so it’s something to get in the habit with sooner rather than later.”

2. Write a Compromise List

We all lead busy lives and searching for your dream home is a journey. That’s why Smith suggests writing down the things that you absolutely need from your future home versus what your ‘nice to haves’ are. “By having that clearly in mind first, it can help ease the whole process and save a lot of your time,” he says. “Consider what aspects of a home you won’t negotiate on, like how many bedrooms you need, the location or whether you want some kind of outside space or backyard.”

Once you’ve done that, you should consider the things that you would be happy to compromise on, such as if you really need a walk-in robe or a second garage if it will cost you more or mean you can’t buy in the location you want to.

“These are all questions to ask yourself so you can set criteria on what you must have and what you could compromise on,” Smith says. “Knowing this will help you understand what type of home you want, and how much you need to save. This will also enable you to have informative conversations with an expert who can help guide you on the path to achieving your goal.”

3. Do Your Research

With the advent of the internet and social media, there is more information available at our fingertips than ever before. When putting in the work to start saving, you may have more options to help you get into the property market than you think. “Recent research shows that 84 per cent of first home buyers do not even know what the First Home Loan Deposit Scheme is and how it enables first home buyers to take out a home loan with as little as 5 per cent deposit,” Smith says. “It’s important to take time to do your research or speak to a mortgage broker to see if you may be eligible for schemes like this to support you with achieving your first home.”

The Aussie chief customer officer advocates for consistent research into the latest Government schemes. “Look into whether you are eligible to apply for one of the 10,000 new applicant places available under the First Home Loan Deposit Scheme from 1 July 2020, before spaces run out. First home buyers may also be eligible to access other state government grants or incentives to run in parallel.”

4. Be Realistic

Smiths fourth tip is to not get too excited by the premise of breaking into the property market. “Buying your first home is exciting but it’s important to work out how much you can afford to spend before you start house shopping,” he says. “Tailoring your search for a home according to what you have the capacity to afford will help avoid any disappointment.”

According to the Aussie specialist, over half of first home buyers feel negatively about navigating the mortgage market by themselves. “Things like council rates, strata fees and insurance are really important to keep in mind,” Smith says. “Getting help from experts, like Aussie Brokers, can help you get familiar with relevant costs and considerations for your local area, not to mention helping work through your personal circumstances to help you get a good deal that suits you.”

Seeking advice from an expert who gets to know your circumstances and is local to your area can help you understand what additional costs you may need to consider, helping you know how much of an extra buffer you may want to save – so you don’t get caught out.

5. Find the Right Deal for You

The other side of the equation is making sure what you think you are signing up for is what you are actually getting. “Buying a home can be an overwhelming process, there is plenty of lingo that can be hard to get your head around. Not only that, buying a home is likely to be one of the biggest financial decisions of your life so you want to make sure you’re doing the right things so you can get a good deal,” Smith says.

“A popular way to wave goodbye to any confusion is to seek expert guidance to help support you through your journey. With 67 per cent of first home buyers intending to enlist the help of a mortgage broker, like Aussie, most recognise the value brokers bring to take the hassle and complexity out of the process in finding a good home loan deal for you.”

6. Take Advantage of Low-Interest Rates

The recent interest-rate cuts have been a boom to first home buyers across the country, with record-low rates on offer. While we hear this phrase get thrown around a lot, many still don’t quite know what that means.

“A home loan is generally a long-term financial commitment and even a small difference in interest can stack up over time,’ Smith says. “Buying your first home often comes with a long-standing mortgage that you sign up for, so now might be a good time to make the most of the property and home loan market, if you can, to access low rates that could save you money in the long-term.”

7. Pre-Approved Loans

Like we said, buying your first home can be one of the biggest decisions of your life. For this reason, it pays to seek reassurance when you’re ready to look at homes you would consider putting an offer in for. Getting pre-approval for a loan can help ease your mind and is beneficial in many ways.

“It gives you a clear indication of the amount of money you can borrow so you can better determine the price of homes you should be searching for,” Smith says. “Another benefit of having a pre-approval is the peace of mind of knowing that when you find that perfect home, you can make an offer that you can afford. Mortgage brokers, like Aussie, can help with the process of pre-approval; putting in the groundwork to give you a smoother process all the way through from your loan approval and walking in the front door of your first home.”

8. Make the Most of Inspections

One of the most exciting parts about buying your first home is heading to inspections. Seeing what you can get for your money in different parts of your chosen city is the crux of what makes the process enjoyable. If you want to buy an existing property, Smith suggests making the most of open inspections.

“Take photos, open cupboards, turn lights on, and try taps. It is also a good idea to walk around the area in daylight and night time. Being thorough in your inspection can avoid the headache of performing possible future repairs,” he says. “If you are choosing to build instead, frequenting open houses can also give you an idea of how you may want your house to feel. A bonus with looking to build right now is the HomeBuilder Grant that gives those building a house access to $25,000. This grant complements existing grants for first home buyers like stamp duty concessions and the First Home Loan Deposit Scheme.”

9. Buy a Home for Tomorrow

Where a number of Aussies run into trouble is through planning. It is important to keep in mind that the home you buy, may very well be your home for many years to come. “With all the effort, persistence and control you need to save, research, and locate a house, it’s important you are buying something you won’t outgrow too soon,’ Smith reveals. “Ask important questions like if you want to raise a family in this home, do you need to be near any specific schools, or have a spare room to be able to host out of town family and friends, to help avoid being too led by emotion when making a decision.

10. Factor Lifestyle into Your Mortgage Repayment Budget

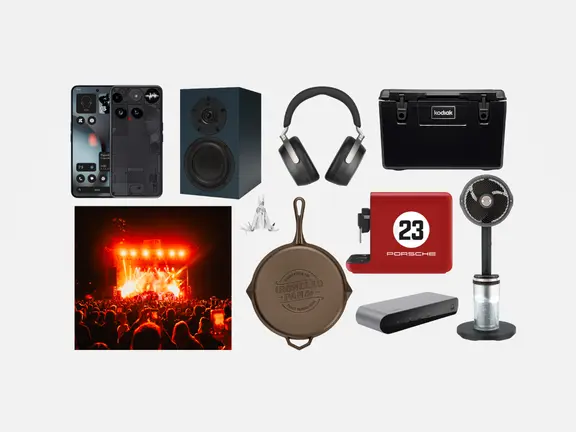

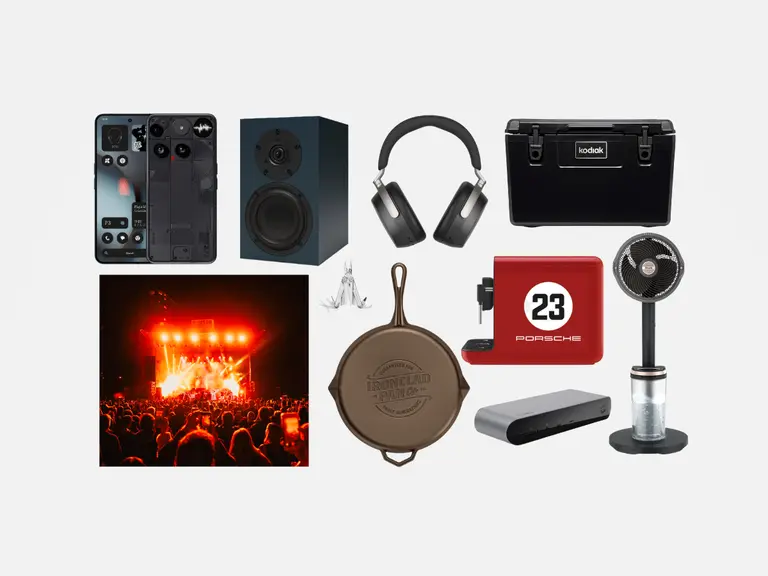

Finally, buying a home isn’t just about the house, it’s about lifestyle. Make sure that you factor in some fun into your budget, rather than blowing it all on mortgage repayments.

“Buying your first home is a big deal and should be celebrated. But the purchase of your first home does not mean you should sacrifice your lifestyle to make the regular repayments,” Smith says. Taking all the necessary steps to know what you can afford, finding a good interest rate and finding the right loan that’s best for you, should make the whole process much easier – leaving you to be able to sit back and relax, enjoying the things you love to do while being a proud first homeowner.

You’ll also like:

What Can I Claim on Tax? A Guide to Working From Home Tax Deductions

Scott Henderson on Life After ‘Men’s Health’

A Beginner’s Guide to Meditation

The First Home Loan Deposit Scheme is an Australian Government initiative to support eligible first home buyers purchase their first home sooner. This initiative allows 10,000 first home buyers to secure their property with a deposit of as little as 5 per cent.

To pay for a home, you can either use cash or take out a mortgage. Most mortgage lenders will require a minimum deposit of 5%–10%, however, there some lenders offer 100% mortgages on shared ownership properties, meaning you may be eligible for a mortgage with no deposit at all. While this happens in some parts of the UK, it is extremely rare in Australia.

Your credit score will determine how willing a lender will be to offer you a mortgage. This score is an assessment of your previous history of making repayments.

Comments

We love hearing from you. or to leave a comment.