Published:

Readtime: 9 min

Every product is carefully selected by our editors and experts. If you buy from a link, we may earn a commission. Learn more. For more information on how we test products, click here.

With June 30 marking the end of the financial year, the time has once again come for us to look at random products around the house and sheepishly ask each other, ‘Can I claim this on tax?’. As we’ve all noted over the past two years, the post-pandemic shift in working conditions has made taxable deductions a little more confusing. Household items, internet services and even computer consumables are now fair game when it comes to filing your tax return, but it’s not a free-for-all.

“Don’t go chasing the deduction! Remember, a tax deduction is not a dollar-for-dollar reimbursement,” financial expert Natasha Janssens told Man of Many. “You only receive a portion back based on your tax rate. If your tax rate is 20 per cent and you spend $100, you essentially save $20 on tax. This means you are still $80 out of pocket – so don’t buy things you don’t need just to get the deduction.”

To make sense of the 2024 tax updates, we’ve put together a handy guide to what you can claim on tax if you worked from home, along with some helpful tips on getting the most out of your return.

What Can I Claim if I Work From Home?

If you work from home, you may be eligible to claim more in your upcoming return. According to Natasha Janssens, an award-winning accountant and the brains behind Women With Cents, Australians can claim 67c for each hour they work from home. This rate will cover the costs of your phone, internet, energy, stationery and computer consumables.

“You can separately claim a deduction for the work-related portion of the decline in value of assets such as your computer, desk, chair as well as repair and maintenance of these items,” Janssens said. “You can’t claim the cost of coffee, tea, milk and general household items (even if your employer normally provides these at work).”

With this in mind, we had Janssens spell out the key things you should be aware of this End of Financial Year, including the lesser-known costs you should be claiming. According to the financial expert, there is a wide range of expenses you can claim when working from home, including:

- Heating, cooling, lighting and cleaning of the area you are working in

- Phone and internet services

- Consumables such as printer ink, stationery or paper

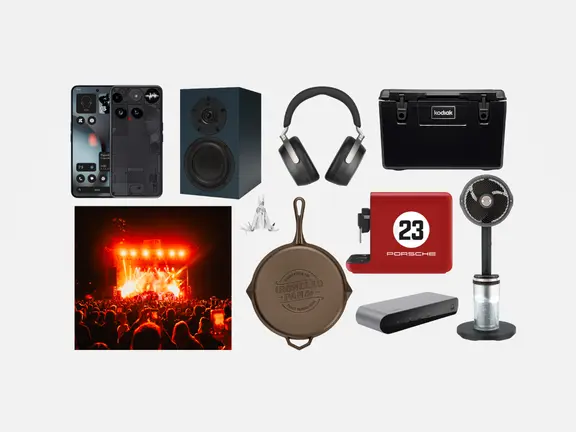

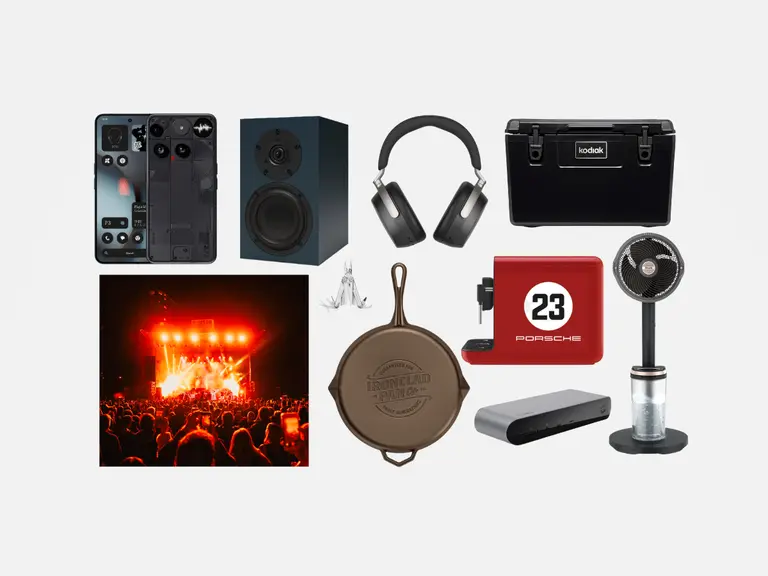

- Home equipment such as a printer, chair, desk, screen or computer – for these items, you can either claim the full cost (up to $300) or the decline in value (items over $300)

Changes to Tax in 2024

Over the last few years, the ATO has made a number of changes to the way we complete our tax returns, however, there haven’t been any significant changes for the 2023-2024 financial year. This year, the most important updates to be aware of include changes to the car expenses method, record-keeping and instant asset write-off program.

- If claiming car expenses using the cents per kilometre method, the rate has increased this FY from 78c to 85c per kilometre (you can claim a maximum of 5,000kms)

- In addition, you are now required to keep a record of the number of hours you worked from home (e.g. timesheet, diary, spreadsheet). Previously you only needed to keep a record for four weeks, but now you will need it for the entire financial year.

- The government has announced it will extend the instant asset write-off for small businesses for another 12 months, enabling them to claim a full deduction for eligible items costing less than $20,000; however, this has not yet become law.

“The ATO is also paying close attention to work-related expenses this year, so it is important to take note of the rules,” Janssens said. “While these did come into effect in the previous financial year, Officeworks research has found 47 per cent of Australians aren’t fully across this. If claiming home office expenses using the fixed rate, the rate is the same as last year, 67c per hour and includes phone and internet, stationery and computer consumables. This did not used to be the case, so be careful not to double dip by claiming these items separately.”

How Do I Make a Claim?

While you may think you know what you’re doing, even the way that we make a claim has changed this year. With personal income tax rates reducing from July 1, Janssens revealed that your deductions are worth more this financial year.

“If there is an item you thought of paying for in July or August, it may be worth bringing into this financial year, but be careful, not all deductions have the same effect,” she said. “If you purchase an item that needs to be depreciated this late in the financial year, you won’t get much benefit. At this late stage, your greatest benefit will come from bringing forward prepaid expenses (e.g. on investment property, such as interest, body corporate fees, etc.) or self-education expenses (course fees), memberships, subscriptions, union fees, donations, and income protection premiums. As always, remember the rules – it has to be an eligible deduction and directly related to your employment.”

You can claim the ATO’s existing flat-rate allowance for working from home of 67c per hour. This covers the extra costs of heating, cooling, lighting and the decline in value of furniture. All you need to do to claim this is to keep a diary – note the time you start work each day, the time you finish work each day and any breaks. You can then claim 67c per hour for each working hour.

In addition, you can also make separate claims for the work-related proportion of items such as your home internet, mobile phone costs, and other expenses that directly relate to your work, such as stationery and printer ink. Janssens explains that the most important consideration is proper record-keeping.

“Officeworks research has found 61 per cent of Aussies believe bank statements are sufficient evidence,” she says. “Fifteen per cent need to go looking for their receipts and 10 per cent don’t keep them. It is important to develop good habits with keeping your receipts as this can help you maximise your deductions and make sure you don’t forget to claim an expense you are entitled to.”

How to Maximise Your Claim

We hear it often, but just what does maximising your tax claim actually look like? According to H&R Block managing director Brodie Dixon, there are a number of small steps you can take to improve your financial standing, making it easier to generate greater returns when it comes time to file your forms.

“Managing your personal cash flow is one of the first steps towards ‘financial freedom’. The better you understand your financial position, the more likely you are to make better decisions to allow your hard-earned money work even harder for you,” he says. “By offering Aussies transparency and allowing them to see all bank accounts and cards in the one platform, with some smart tools, they can get a better handle on their spending and budgeting, helping to reduce debt and increase savings. They can also identify transactions that may be tax deductible, and share these with their Tax Agent, ensuring they get the maximum refund possible at tax time.”

A further option is to claim the actual work-related portion of all your running expenses, which you will need to calculate on a reasonable basis. This is a considerably more labour intensive process and requires careful documentation of all expenses, but it will often produce a bigger claim and is best calculated with help from your tax agent.

“The best way to maximise your return is by maximising your deductions,” Dixon explains. “The first step towards this is understanding your occupation-specific deductions. If you work from home, there is also a range of working-from-home expenses you can claim whether you work from home full-time or part-time.”

Is There Anything I Can’t Claim?

Take it from us, the last thing you want is the ATO auditors knocking at your door, so it pays to know what you can’t claim as well. Unsurprisingly, you can’t claim for the cost of tea, coffee, milk and other household items your employer might have paid for at work. You also can’t claim costs associated with home-schooling your children, like buying them iPads and desks.

It bears reminding, however, that people who run a business from home may lose part of the Capital Gains Tax exemption on their home for the part of the home that is used in their business. According to Dixon, here is a list of everything you can’t claim this financial year;

- Household items

- Costs associated with home-schooling

- Occupancy costs – Mortgage interest, rates, home insurance

Common Claim Mistakes

With that in mind, it’s easy to fall into the same traps. Here are the common mistakes Aussies make when trying to claim their tax

- Failing to claim what they’re entitled to – You’re entitled to claim a deduction for any expense which you incurred in earning your income. So, if you have incurred a work-related expense, and you have the paperwork to prove it, don’t hesitate to claim it.

- Embellishing deductions – You can only claim what you’ve spent. So, don’t inflate deductions in order to get a bigger refund and only claim for costs you can prove you spent, by producing an invoice, receipt or bank statement, for instance. If your deduction claims are found to be incorrect, you will be required to repay the tax avoided, plus pay interest.

- Relying on pre-filled data from the ATO – These days, with the push of a button, you can pre-fill lots of your income information straight from the ATO’s systems. Take care though and don’t assume that income data is correct or complete. Always use your own information (payment summaries, etc) as the key source data. Some people assume that because the data comes from the ATO, it must be right. That’s a dangerous assumption. If you omit income and get questioned by the ATO, the legal burden will be on you, even though you’ve taken the information straight from the ATO’s pre-filled data.

Comments

We love hearing from you. or to leave a comment.