Published: Last Updated:

Readtime: 10 min

Every product is carefully selected by our editors and experts. If you buy from a link, we may earn a commission. Learn more. For more information on how we test products, click here.

“Money doesn’t grow on trees.” Or does it? “Money can’t buy you happiness.” Or can it? No doubt money is a popular topic of chatter, especially with the financial year-end approaching, which gives us all an opportunity to reflect on our own personal finances and see how we are sorted for the coming year. In having a chat with some mates recently it became apparent that comfort with, and an understanding of, personal finances varied greatly amongst friends. Some friends are reading AFR on the reg, have purchased apartments and are diversified in multiple markets, others have but a savings and checking account, others still prefer to keep each fortnightly pay in cash under their mattress.

You’ll also like:

- 25 Simple Ways to Make Extra Money

- Australia’s Best Stock Trading Platforms & Brokers

- How to Buy Stocks: A Guide to Investing for Beginners

While I am no expert, I do have expert friends. I wanted to write this piece to educate my friends, and readers, and demystify the investment market. Sometimes all the words are confusing, sometimes it doesn’t even sound that interesting, however, I feel strongly that if you have any income at all, you should be trying to extract as much as possible from each dollar. I speak to Glen Hare of Fox & Hare Wealth and Andrew Macken of Montgomery Investment Management, mates of mine and local financial gurus, about how one achieves baller status.

In simple terms, what is investing?

Glen: “You’ve worked hard for the money. Make the money work hard for you! When you invest, you’re putting those dollars to work.”

Andrew: “I define investing as ‘buying a dollar for fifty cents’. Investing is about making sure the price you pay is less than the value you receive.”

When should you start investing?

Glen: Investment is very similar to your personal fitness regimen, you’ll reap the rewards regardless of whether you start now, next year or in 2023. Of course, those who start now are going to be in much better shape than those who were a little later off the blocks. I would say that right now is absolutely the best time to start. How much is of little consequence. Investment is not only a rich man’s game, so long as you can put some aside you’re well on the way to becoming an investor.

Andrew: Most would agree that people should start investing as soon as possible. This advice is based on what’s known as the “miracle of compounding.” That is, investments will compound over time and increase exponentially, not linearly. So investing from a younger age really helps you down the track.

How should a newbie get started?

Glen: Coming back to the personal fitness metaphor, many of us would struggle to walk into the gym and unleash our inner Arnold without the help of a trainer. Investment is no different, find a reputable financial advisor and reach out. Many offer free consultations and will provide a detailed plan of attack before they even consider a dotted line. It’s a great way to find out your potential without risking a cent.

Andrew: The worst thing a newbie can do is rush out and buy a bunch of shares in random companies listed on stock exchanges. Investing well on a sustainable basis is really, really hard. If you saw me win big on the roulette table, you would not rush to place your money on my prior bet; no one does that because you understand it was simply a lucky bet and not a skillful pick.

Investing well on a sustainable basis can be achieved by highly-skilled, dedicated teams that apply a rigorous investment process with extreme discipline over time. Individuals typically do not have the time or the inclination to replicate what full-time investment teams can achieve. Finding the right team is not easy. Take your time; conduct your research, and perhaps talk to a trusted advisor/friend.

What are some of the biggest considerations when investing?

Glen: There are quite a number of things to consider when embarking on your investing journey, however here’s a few things that definitely need to be in your shortlist. Firstly, pick investments that are appropriate for you and the level of risk you are willing to take on. Don’t put all your eggs in one basket, diversify your investments. Manage how much risk you take on by the size of your investments i.e. take a smaller exposure to riskier assets. Finally, consider the time-frame of the investments (ex: will you need funds to buy an apartment or go back to school or can you hand over a chunk of change and not touch it for decades), as this will also impact your decisions around what specifically to invest in.

Andrew: The most important concept in investing is also the least understood. It is the concept of risk. So when you make an investment decision, the challenge is to think about all the possible scenarios of what might happen in the future; and then to think about how likely each scenario is. This is not easy. But it is the way good investors will separate the great opportunities from the poor ones. A great investment opportunity is one that has a low chance of turning out poorly and a high chance of turning out well.

Now, you might have heard that without taking a risk, there will be no reward. This is true. But what is NOT true is that if you do take a risk, there will definitely be a reward.

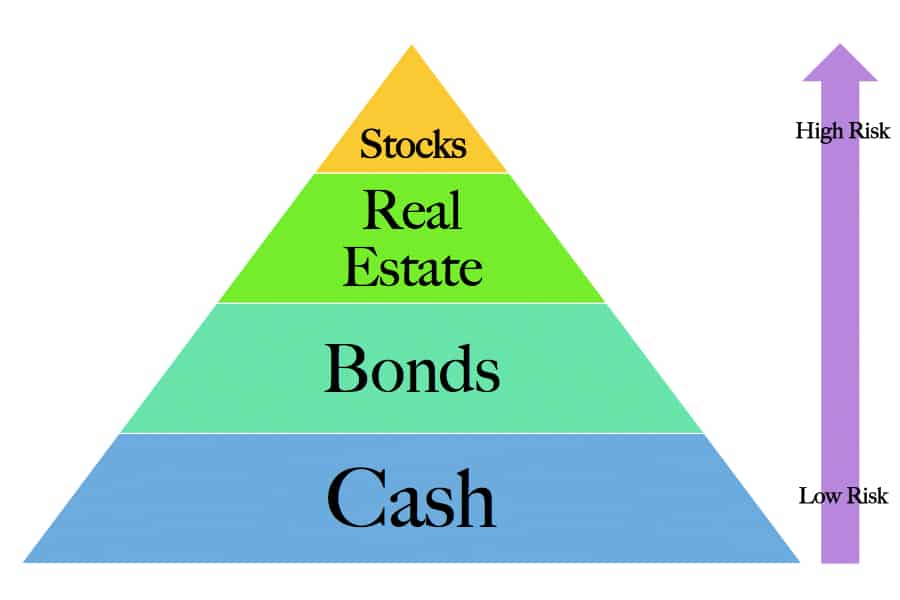

What are the basic types of investments and how would you define them?

Here are four types of investment from least, to most, risky:

Cash – This is exactly as it sounds, money in the bank. Not the highest returning option but certainly one of the safest.

Bonds – Hand your cash over to the bank for a fixed period and they will reward you with a slightly higher interest rate than your regular savings account. Be aware that you will not be able to access this money until the term expires.

Property – This refers to buying ‘bricks and mortar’. The property market has exploded in Australia over the last couple of years and has been a good investment for many. Don’t kid yourself though, a property is not the failsafe option that the mainstream would have you believe. Like any investment, it needs to be given careful consideration. Property can be a fantastic investment but does not come without costs, interest on the mortgage, strata, council rates, utility bills, general upkeep of the property, property management fees, stamp duty, legal fees, bank fees etc….

Shares/Stocks/Equities – These are all the same thing. They basically refer to owning a portion or a ‘share’ of a company. This means that you can be rewarded with an increase in value based on the underlying performance of the company to which you own ‘shares’ in. You also can receive a ‘dividend’ or a share in the profits of the company, again based on how many shares you own. It is relatively cheap and easy to buy/sell shares but the market can be volatile.

Managed Fund – Rather than picking the shares you invest in you can outsource this to a fund manager. A fund manager is a person or team responsible for running and picking investments for a Managed Fund. Funds can be any combination of the above!

What are the advantages of an advisor?

Glen: Let’s consider Michael Phelps, the most successful Olympian in history (28 medals and counting!). The guy is obviously a perfect storm of natural talent and physical prowess but there is no way that he got to that level without help. Cristiano Ronaldo, Usain Bolt, Jonah Lomu, all legends in their respective fields, but none of them made it to the top without the help and expertise of others. Think of your current profession and income as your own perfect storm of talent and prowess. Maybe you are blessed with a rock star career and boundless expendable income, maybe not. Financial advisors exist to take what you’ve got and make it better, regardless of where you are on the ladder.

Andrew: Investing well on a sustainable basis is extraordinarily difficult. For an individual, it’s near impossible. The benefits of a financial advisor are that they can help you evaluate potential outsourced investment options and make recommendations. My recommendation would always be to supplement external advice with your own research and instinct. And remember, start along the dimensions of integrity, discipline, and aligned incentives when evaluating potential external managers. Without all of these all of the time, there is no future with that manager.

What sort of people/demos do you work with? How do YOU make money?

Glen: At Fox & Hare, we have 3 coaching programs that the client chooses from based on the complexity of their financial situation. Each program has an associated fixed upfront and ongoing coaching fee. By building a deep understanding of the life our clients aspire to live, on an ongoing basis we coach, educate and advise them on how best to achieve their short, medium and longer-term goals.

Andrew: At Montgomery, we only make money when our clients make money. This is unusual. Most business models are focused on extracting more value out of their customers. Our business model is focused on generating the best possible returns for our investors – in a portion of which, we share. When we invest well, our investors make more money and we make more money. Also – and this is key – every member of my team is an owner in our business and an investor in our funds. We stand side-by-side with each of our investors to always ensure the greatest possible alignment of incentives.

Meet Glen:

A ten-year veteran of Macquarie Bank, with a Bachelor of Commerce-Accounting; Glen was one of the youngest Directors to ever work at the bank. Glen left in mid-2017 to launch Fox and Hare Wealth.

Meet Andrew:

Andrew Macken is Chief Investment Officer and Co-Founder of Montgomery Global Investment Management and Montaka Global Investments. Andrew joined Montgomery in March 2014 after spending nearly four years at Kynikos Associates LP in New York. Prior to this, Andrew was a management consultant at Port Jackson Partners Limited in Sydney for nearly four years, focusing on strategy for clients in Australia and abroad.

Andrew holds a Master of Business Administration (Dean’s List) from the Columbia Business School in New York. Andrew also holds a Master of Commerce and a Bachelor of Engineering with First Class Honours from the University of New South Wales, Sydney.

You’ll also like:

- 25 Simple Ways to Make Extra Money

- Everything You Can Do Once NSW Hits 80% Vaccinated

- How to Buy Stocks: A Guide to Investing for Beginners

- The “Three Comma Club” – Forbes Billionaire List 2018

Disclaimer: The advice provided on this website is general advice only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this advice you should consider the appropriateness of the advice, having regard to your own objectives, financial situation and needs. If any products are detailed on this website, you should obtain a Product Disclosure Statement relating to the products and consider its contents before making any decisions. Where quoted, past performance is not indicative of future performance. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information on this website is no substitute for financial advice.

Comments

We love hearing from you. or to leave a comment.