Published:

Readtime: 6 min

Every product is carefully selected by our editors and experts. If you buy from a link, we may earn a commission. Learn more. For more information on how we test products, click here.

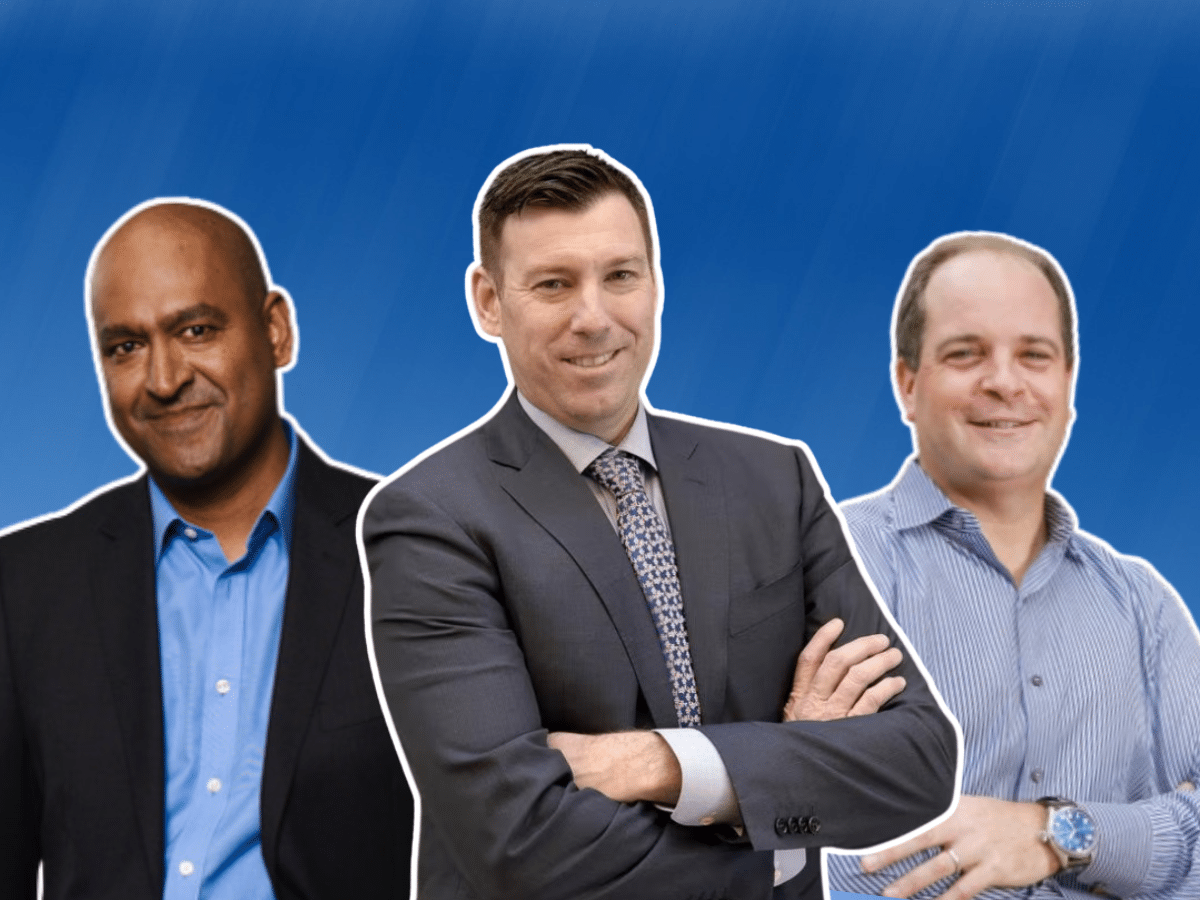

Australia’s highest-paid chief executives for 2025 have been revealed in the BOSS annual CEO pay survey, compiled by OpenDirector and Odgers and published by the Australian Financial Review.

One thing is clear: if you were running a mining company this year, you probably made a fortune. Thanks to the surge in gold prices and booming demand for critical minerals, a handful of small and mid-tier miners have turned into heavyweight success stories. The result was multimillion-dollar paydays, huge option windfalls, and one of the widest gaps yet between what CEOs report and what they actually take home. That’s before you compare their pay to the rest of the workforce.

The highest earning CEO in Australia this year is Develop Global boss Bill Beament, who walked away with AUD$59.6 million. Most of that came from a jump in the value of company shares he bought a few years ago, which surged as gold rallied. It is one of the biggest CEO windfalls recorded in Australia, but who comes second? Let’s find out!

Of course, with so much to dig out of the ground in Australia, Mr Beament wasn’t the only miner cashing in. Mining executives dominated the upper pay ranks:

- Paul Savich from WA1 Resources earned $20.8 million after a significant mineral discovery.

- Raleigh Finlayson, CEO of Genesis Minerals, pocketed $14.9 million as the stock climbed sevenfold.

- Luke Creagh of Ora Banda Mining also cracked eight figures after a strong year for gold.

That said, while miners dominated the take-home pay list, Macquarie Group chief Shemara Wikramanayake remained Australia’s highest-paid CEO according to official figures. She earned $29.3 million for the fifth year running. Her position at the helm of a global financial powerhouse keeps her at the top of the statutory rankings, although she appears further down once share-based payouts are included.

So what’s driving the huge numbers? To put it simply:

- Rising share prices

- Long-term bonuses vesting at the right moment

- A handful of companies are experiencing explosive growth

That mix created a widening gap between reported pay, as shown in annual reports, and take-home pay, which reflects what executives actually received after their shares and bonuses were paid out. In 2025, that gap reached new heights.

Top Earners: Biggest Take-Home Pay in 2025

| Rank | Name | Company | Realised Pay |

| 1 | Bill Beament | Develop Global | $59.6m |

| 2 | Michael Farrell | ResMed | $45.6m |

| 3 | Vikesh Ramsunder | Sigma Healthcare | $26.8m |

| 4 | Shemara Wikramanayake | Macquarie Group | $24.0m |

| 5 | Paul Savich | WA1 Resources | $20.8m |

| 6 | Greg Goodman | Goodman Group | $20.4m |

| 7 | Anastasios Arima | IperionX | $17.8m |

| 8 | Jakob Stausholm | Rio Tinto | $15.6m |

| 9 | Raleigh Finlayson | Genesis Minerals | $14.9m |

| 10 | Michael Henry | BHP | $13.7m |

How CEO Pay Compares to the Average Australian Worker

If the numbers seem difficult to grasp, consider the following reality check. The average full-time Australian worker earns around $98,000 a year. That means:

- Bill Beament earned roughly 600 years’ worth of the average salary in a single year.

- CEOs further down the list still earned the equivalent of 100 to 200 years of an everyday wage.

- Macquarie’s Shemara Wikramanayake, on nearly $30 million in reported pay, takes home more in one week than many Australians earn in a year.

It serves as a reminder of the widening gap between the top end of town and the rest of the workforce, and how executive pay now increasingly depends on rising share prices rather than base salaries.

Top Earners: Highest Reported Pay

| Rank | Name | Company | Realised Pay |

| 1 | Shemara Wikramanayake | Macquarie | $29.3m |

| 2 | Michael Farrell | ResMed | $22.6m |

| 3 | William Oplinger | Alcoa | $20.8m |

| 4 | Tom Palmer | Newmont | $19.9m |

| 5 | Aaron Erter | James Hardie | $14.3m |

| 6 | Greg Goodman | Goodman | $14.2m |

| 7 | Paul McKenzie | CSL | $13.8m |

| 8 | Michael Henry | BHP | $13.1m |

| 9 | Peter Konieczny | Amcor | $13.0m |

| 10 | Ryan Stokes | SGH | $12.7m |

How the ACSI Rankings Compare

While the AFR list captures the biggest earners of the past year, the Australian Council of Superannuation Investors (ACSI) provides a separate snapshot each June, when it releases its own rankings of ASX 200 chief executives. Because ACSI analyses pay once annual reports are finalised, its data often reflects a slightly earlier financial year, but the comparison helps show how the country’s largest companies stack up.

In ACSI’s most recent report, News Corp CEO Robert Thomson led the pack with $42 million in realised pay. He was followed by Victor Herrero, the chief executive of Lovisa, with earnings of $39.5 million, and Shemara Wikramanayake, who earned $30 million as the only woman in the top 20.

ACSI also noted that several of the highest-paid CEOs were based in the United States, reflecting the influence of North American pay practices.

According to the council, leaders of Australia’s largest listed companies now earn 55 times the average Australian worker’s wage, up from 50 times the year prior. Even so, the gap has narrowed dramatically compared with 2014, when ASX 100 CEOs earned 71 times more than the average full-time worker.

The median realised pay for ASX 100 CEOs stands at $4.15 million, up from $3.96 million a decade earlier. For smaller ASX-listed companies, median pay has risen from $1.74 million to $2.2 million over the same period.

ACSI’s Executive Manager of Stewardship, Ed John, says Australia remains relatively restrained compared to other major markets. UK CEOs earn more than 100 times the median salary, and in the United States, the figure exceeds 300 times for the largest companies.

Despite the blockbuster numbers, only four women appear in the top 50 list. It serves as a reminder that while executive pay continues to rise, representation at the very top still advances at a glacial pace.

Mining dominated the conversation this year, but CEO pay never stays still for long. Markets rise, bonuses vest, and fortunes swing. In 2025, one strong gold run was all it took to turn a few executives into multimillionaires almost overnight.

FAQs

What is the take-home pay for a CEO?

Take-home pay, also called realised pay, is the amount a CEO actually receives in a given year. It includes salary, bonuses and the value of shares or options that vested that year. If the company’s share price rises, this number can grow significantly.

What is reported pay?

Reported pay is the amount of money companies list in their annual reports. It includes fixed pay and an accounting value for shares and performance rights at the time of their grant. It does not always match what the CEO actually receives.

What is statutory pay?

Statutory pay refers to the total remuneration figure that companies are legally required to disclose. It includes salary, bonuses and the accounting value of shares and performance rights when they are granted.

What does vesting mean?

Vesting is when a CEO officially becomes entitled to shares or performance rights they were previously granted. They typically vest after achieving performance targets or remaining with the company for a specified period.

What are options?

Options give a CEO the right to buy company shares at a fixed price. If the share price rises above that level, the option becomes profitable and can create a significant windfall.

What is realised value?

The realised value is what a CEO earns once they exercise their options or when their shares vest. It reflects real market value at the time, not the estimate used in annual reports.

Comments

We love hearing from you. or to leave a comment.